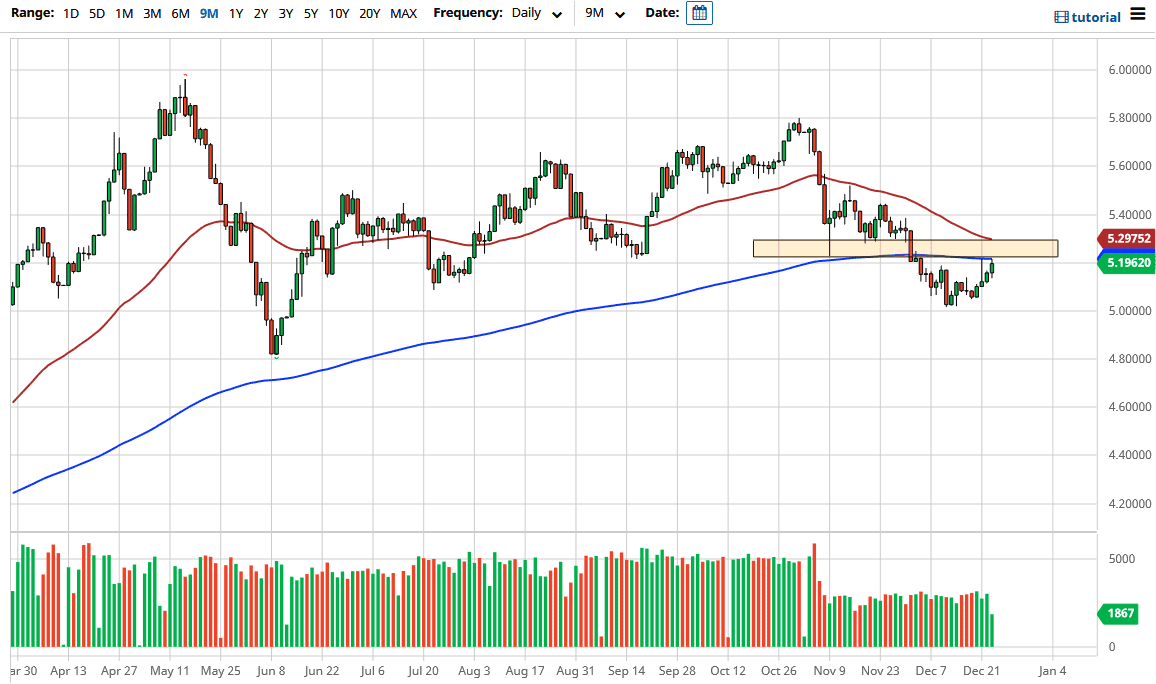

The US dollar rallied during the trading session on Wednesday to reach towards the 200-day EMA against the Brazilian real. The Brazilian real is an emerging market currency that is highly levered to the idea of growth in South America, and therefore can be rather volatile. As we are testing a major area of confluence, we may have a trade setting up for the next several sessions.

Thursday is Christmas Eve, which means that markets will be very thin. This is a market that you need to be watching for the next couple of days, perhaps setting up for a nice trade. I would draw your attention to the Monday candlestick which was a massive shooting star that reached towards the 200-day EMA and then pulled back rather significantly. We have since reach towards the top of the candlestick and are testing that same 200-day EMA yet again.

Even if we break above the 200-day EMA, there is a significant amount of resistance at the 50-day EMA as well, where we had seen serious selling a couple of weeks ago, which coincides with that level of 5.30 above. At this point, it is only a matter of time before we see enough exhaustion to start shorting this market. That will also be the case if we see the US dollar fall in general, as it tends to move in one direction against most currencies. If there is more of a “risk on” rally around the world as far as risk appetite is concerned, that should favor the Brazilian real as well.

In fact, there is a significant amount of resistance all the way to the 5.40 real level, so it is not until we break above there that I will start to worry about the downtrend. You can also make an argument that the 50-day EMA is going to break down below the 200-day EMA forming the so-called “death cross.” For what it is worth, there are multiple emerging market currencies that are very strong against the greenback, so I think that the Brazilian real will more than likely continue to strengthen.