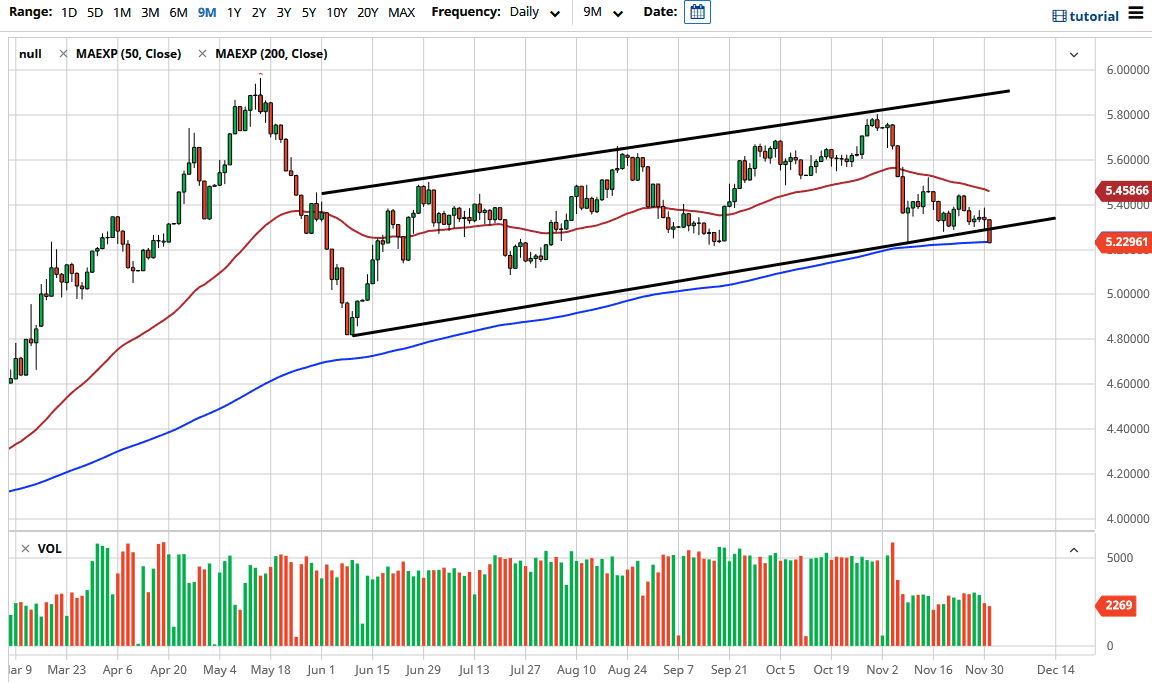

The Brazilian real strengthened during the trading session on Tuesday to reach down towards the 200-day EMA. This is a long-term trading indicator that many people will be paying attention to for the trend, but it certainly looks as if the US dollar is vulnerable to most currencies. We will probablly see the Brazilian real strengthen against the US dollar, as the US dollar is losing strength against almost everything. The USD/BRL pair should have a bit of support right in this area, but if we break down below the 5.20 level, it is likely that we will continue down to the 5.00 level.

Short-term rallies at this point will continue to get sold into, and you can even make an argument for a descending triangle. Therefore, one could suggest that perhaps the US dollar has further to go and, based on the overall behavior of the US dollar, we have further to go against most pairs. If there is a major “risk-on rally” out there, the Brazilian real will attract a lot of attention. With vaccines coming down the road, a lot of people will continue to see the idea of expanding out to emerging markets as very possible. It is likely that we will see a drive lower, as the US dollar has suddenly found itself on its back foot.

Keep in mind that a lot of stimulus coming out the United States will influence what happens with the greenback as well. The candlestick has a long red body and is closing at the very bottom to show signs of strength for the Brazilian real. Rallies at this point should continue to be sold into, unless we break above the 50-day EMA, which is currently sitting at the 5.45 handle. If we were to break above there, then it would change everything. But right now, I do not see that happening, and volume is most certainly shifting away from the greenback. The USD is now looking for better returns in emerging markets, not just Brazil. This is a market that is starting to change its trend.