The Brazilian real strengthened against the US dollar during trading on Tuesday as we continue to see stimulus drive the value of the US dollar lower. The Brazilian real is highly coveted by those looking to put more of a “risk-on trade” into the marketplace. After all, the Brazilian real is a proxy for Latin America and growth in general. The Brazilian economy is one that is highly levered to various commodities, but more importantly, it is attached to the idea of extreme growth.

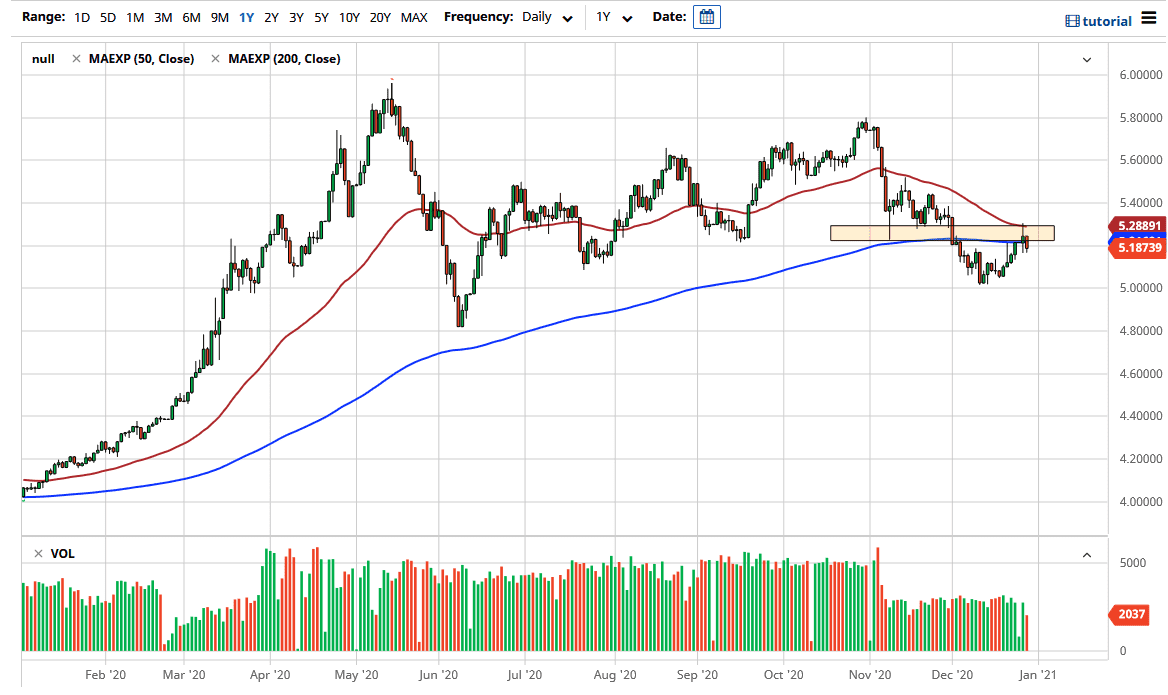

With stimulus coming out the United States it makes sense that the greenback has lost a little bit of strength, as we have seen since the beginning of November against the Brazilian real. Since then, we have seen a little bit of a bounce, but during the trading session on Monday, the 50-day EMA offered resistance, and then during the day on Tuesday we have seen this market turn around and break below the 200-day EMA yet again, near the 5.20 BRL level.

Looking at this chart, the 5.00 level is an area in which we have seen a lot of support recently, and it makes a nice target as we will continue to go lower. If we can break down below the 5.00 level, that could open up the floodgates and send this market much lower. With the massive amount of stimulus flowing into the markets, I believe that the overall selling of the greenback should continue against most currencies, and it will be particularly interesting to see whether or not we can see that the emerging markets will continue to strengthen in general.

The market did bounce from the 5.17 level during the day on Tuesday, just as it did on Monday. However, if we break down through that level, that will kick off the move towards the 5.00 level initially. The 50-day EMA sits at the top of the candlestick from the Monday session like I said, so if we do rally from there, I think the 5.50 level will offer massive resistance. I have no interest in buying this pair anytime soon, unless for some reason stimulus was suddenly going to stop. I do not see that happening, and we are most certainly in a downtrend over the last couple of months so there is no reason to try to fight that.