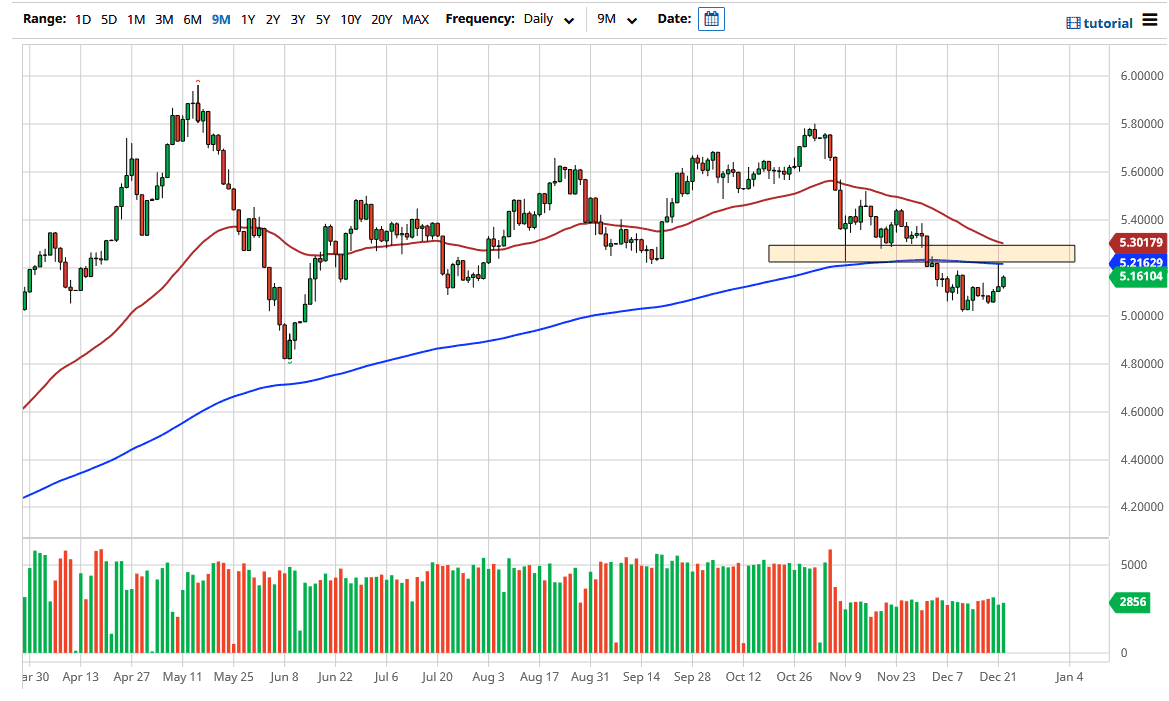

The Brazilian real lost strength during the trading session on Tuesday as the US dollar got a boost against most currencies. As long as there is a “risk off” sentiment in the world, that will continue to work against emerging market currencies such as the real, so we have the possibility of continued momentum to the upside. The 20- day EMA sits just above, so it is worth noting that a bit of technical resistance is about to make itself known. In fact, we have seen the shooting star from the previous session show signs of exhaustion, so it is only a matter of time before sellers show up towards the top of the candlestick. The 5.22 level is a significant area of previous selling, and therefore should offer resistance.

To the downside, the 5.00 BRL level has been important recently, and it is a large, round, psychologically significant figure. If we do break down below there, it would show a major “risk on rally” in emerging market currencies beyond just this one. Remember, Brazil is considered to be an emerging market, and it is going to be very volatile when it comes to whether or not people are willing to put risk out there. I do recognize that this is the wrong time of year to expect a sustainable move, but this is a market that continues to see an overall downtrend when it comes to the greenback. That will show itself here as well, so pay attention to the US Dollar Index as it could give us a bit of a “heads up” as to where this pair will go. This will be much more sensitive to US dollar strength than other currency pairs such as the EUR/USD pair, the GBP/USD pair, etc.

Another thing to pay attention to is the fact that the 50-day EMA is getting ready to cross below the 200-day EMA, the so-called “death cross” that can send the markets lower from a longer-term standpoint. The market is going to continue to see volatility, but it certainly looks as if the downtrend is very much intact. The fact that we bounce from the 5 handle should not be much of a surprise.