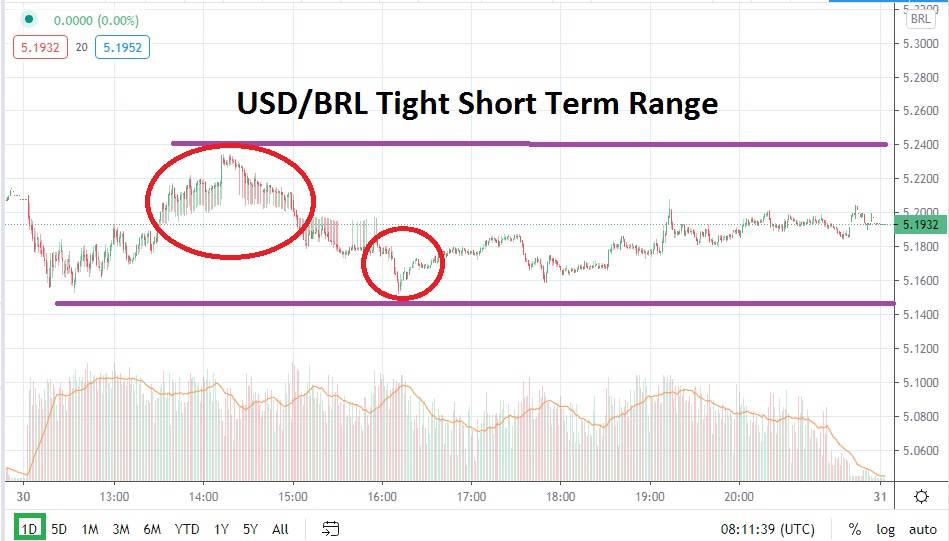

The holiday season has seen tight trading within the USD/BLR emerge the past week, but what should grab the attention of speculators is the ability the pair has shown to sustain its current value range. The past six months of trading within the USD/BRL has displayed plenty of choppy results. Although the trading of the Forex pair has not been overly volatile, it has certainly not correlated to the weakened US dollar like many other major currencies which have produced bearish trends against the USD.

However, since late October, the USD/BRL has begun to prove it has the capability to build a bearish trend. Yes, there have certainly been reversals higher on occasion, but the ability of the USD/BRL to create downward momentum and challenge important support levels has been exhibited. The current value of the Brazilian real near 5.19000 is interesting for two important reasons: one, it is trading within shouting distance of the mid-December lows when the USD/BRL approached the 5.0400 juncture; two, the value of the Forex pair has shown it can sustain its value below the 5.2000 level.

Resistance between 5.2000 and 5.3000 should be monitored by speculators; if this value range can prove it sparks reversals lower upon being challenged short term, it may signal that additional bearish activity can develop for the USD/BRL. Traders can certainly target the 5.1500 to 5.1100 support levels if they are sellers.

The question for speculators now is how to handle the rather tight consolidation within the USD/BRL. Holiday trading volumes have created a value range which has not veered far away from its present price vicinity except for quick momentary flashes which have tested nearby support and resistance levels. Patience will be important for traders near term.

However, the closely held range of the USD/BRL may be the key to taking advantage of its current trading range. If current prices hold steady and remain calm during the remainder of the holiday season short term, the USD/BRL may be preparing for a potential breakout to develop. The Forex pair has been able to show it is capable of producing a bearish trend the past couple of months. The fact that the USD/BRL is lingering near important support levels is another point which should be contemplated and might tempt speculators to be sellers.

Brazilian Real Short-Term Outlook:

- Current Resistance: 5.2500

- Current Support: 5.1500

- High Target: 5.3100

- Low Target: 5.1100