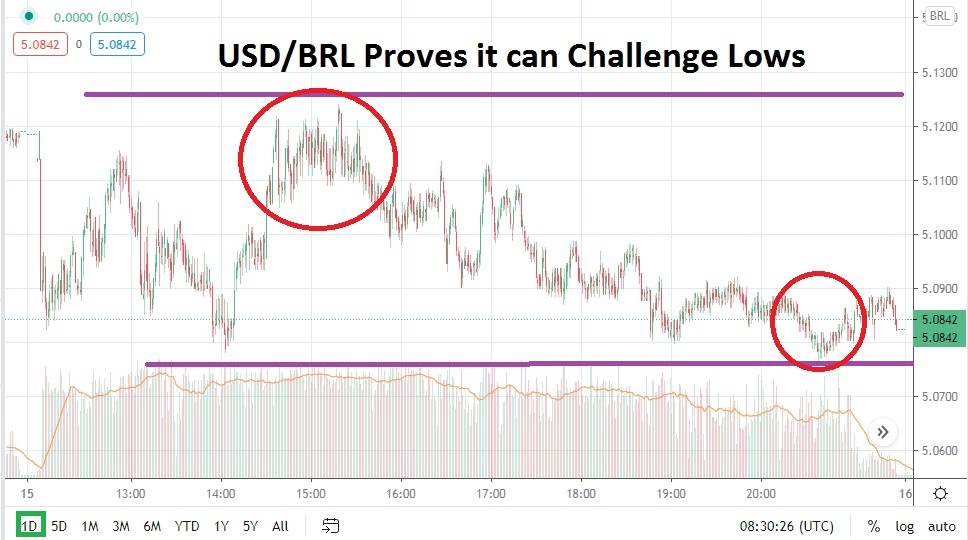

Important support levels are now being challenged by the USD/BRL as it challenges values not sincerely tested since the second week of June. The Forex pair has created downward momentum since late October and incrementally continues to see resistance levels lower technically.

As of this morning, the USD/BRL is near the 5.0800 juncture, and earlier this week, the Forex pair did test the 5.0100 level. Although a reversal higher did occur when the low water mark was touched on Monday, the USD/BRL has continued to display an ability to stay within a rather tranquil range and prove that resistance levels are adequate. Speculators may remember that trading the USD/BRL the past six months has provided plenty of choppy conditions, but the current trend of the Forex pair is beginning to show a sustained amount of momentum downward.

If the value of the USD/BRL can sustain its current stance and continue to hover near support levels, it may be signaling that another thrust downward could occur. The 5.0000 could prove to be a vital psychological level for financial institutions with the USD/BRL. The value was broken lower in early June of this year and, on the 8th of that month, the USD/BRL did hit the 4.8600 level before reversing higher in a fast manner. If the 5.0000 level proves vulnerable, the next support ratio of 4.9700 should be watched.

If and when the 4.9700 mark is brushed aside, this reality could produce swift and volatile trading within the USD/BRL. However, for those levels to be tested, speculators will cynically note that we have to get there first. The USD/BRL has proven to be a rather stubborn Forex pair the past six months and its current trend still may not be completely accepted by some technical traders.

Traders looking for reversals higher cannot be blamed, but they should be looking for quick-hitting trades that are likely going to need take profit limit orders to take advantage of small movements upward. Resistance levels near the 5.1200 to 5.1700 levels do look appropriate as take profit targets for short-term speculators who want to pursue reversals.

However, selling the USD/BRL continues to look like a winning formula. Traders need to be patient with the Brazilian real; it does have a tendency to move in a rather quiet manner, but the bearish trend of the USD/BRL continues to prove alluring technically.

Brazilian Real Short-Term Outlook:

- Current Resistance: 5.1200

- Current Support: 5.0300

- High Target: 5.1700

- Low Target: 4.9700