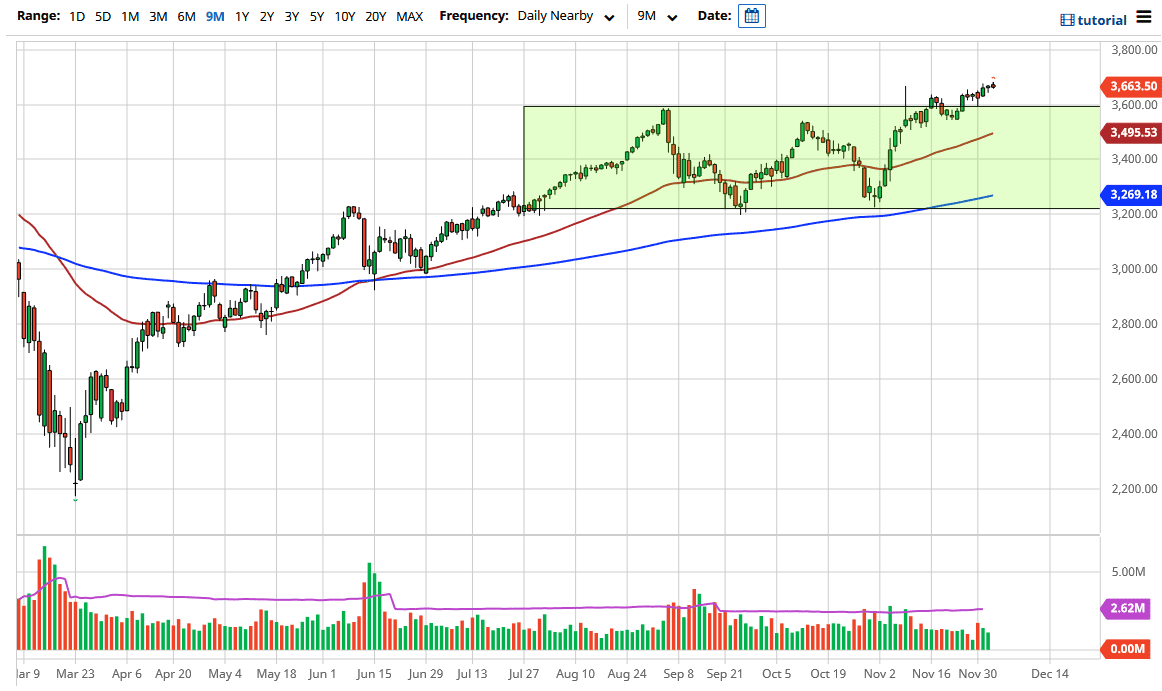

The S&P 500 has gone back and forth during the trading session on Thursday, in a relatively tight range for the day. Ultimately though, this is a market that I think will continue to see buyers coming in on dips due to the fact that there is so much liquidity out there. After all, the stock markets move on liquidity more than anything else. This being the case, the market will be looking at the 3600 level with special interest as there has been so much in the way of resistance there and therefore a certain amount of “market memory” could come into play.

All things being equal, I also believe that the 50 day EMA underneath at the 3500 level should offer plenty of psychological support as well. Keep in mind that the Friday session features the Non-Farm Payroll numbers come out and that of course will have a certain amount of an influence on the markets. Nonetheless, I do believe that it is only a matter of time before buyers will jump in on this market and therefore if we get some type of horrific jobs number there may be a bit of a “knee-jerk reaction” to the downside, which people will turn around and start buying due to the fact that they will be hoping for stimulus and more free cash coming from the government.

The candlestick was rather unimpressive, so it is not a huge surprise to see that we may get a little bit of a pullback and it should not be a huge surprise to see that the market might have been a little bit cautious about putting a lot of money to work heading into the jobs number but at the end of the day Wall Street will find a way to talk itself into buying again, that is what it does. After all, the narrative is almost always positive, and you have to keep in mind that the S&P 500 has absolutely no relation to the economy, at least not in the last 13 years. As long as the Federal Reserve continues to distort the economics of the S&P 500, it is difficult to imagine that the market will fall for any significant amount of time, regardless of the jobs number that comes out. After all, people will be looking for a “good news is good/ bad news is good” type of situation