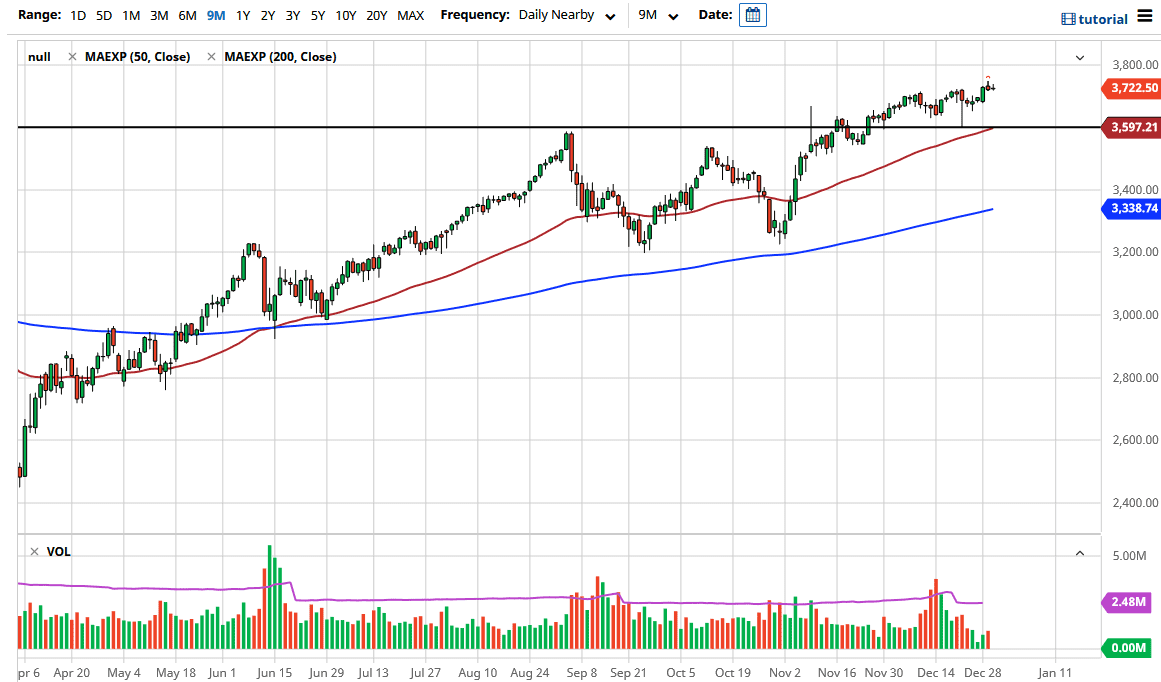

The S&P 500 did very little during the trading session on Wednesday as we head towards New Year’s Eve, and traders are probably focused more on holidays than on trading. This is a market that is very bullish in general and it is only a matter of time before the buyers come back on any dips. Volume will be thin and Thursday will be a shortened trading day, so I do not think that you can read too much into the action over the last couple of days, including the Thursday candlestick about to be printed.

Underneath, the 3600 level offers plenty of support based upon previous action and the fact that the 50-day EMA is sitting right there. Dips offer value that people can use to their advantage. We are in an uptrend, so short-term pullbacks should be opportunities to pick up a bit of value in order to hang on to the longer-term situation. The market could go looking towards the 3800 level initially, but longer term we will go looking towards the 4000 handle.

Underneath, there has been a consolidation area formed between the 3200 level and the 4000 level, and now that we are out of it the measured move on the breakout should send this market looking towards the 4000 handle. This also suggests that the 3600 level underneath should be supported, as market memory should come back into play. This is a market that I think will continue to see volatility, but with stimulus out there being signed into law, it should continue to propel the market higher. This is especially so considering that the debate rages on regarding the size of stimulus checks going to Americans, which could be as high as $2000. That helps solidify spending, which is 70% of the US economy. Regardless, between all of that and the shrinking US dollar, it makes sense that the S&P 500 should continue to go much higher. I have no interest in shorting this market, because it is far too bullish, and it is difficult to imagine a scenario in which we would see a big move to the downside.