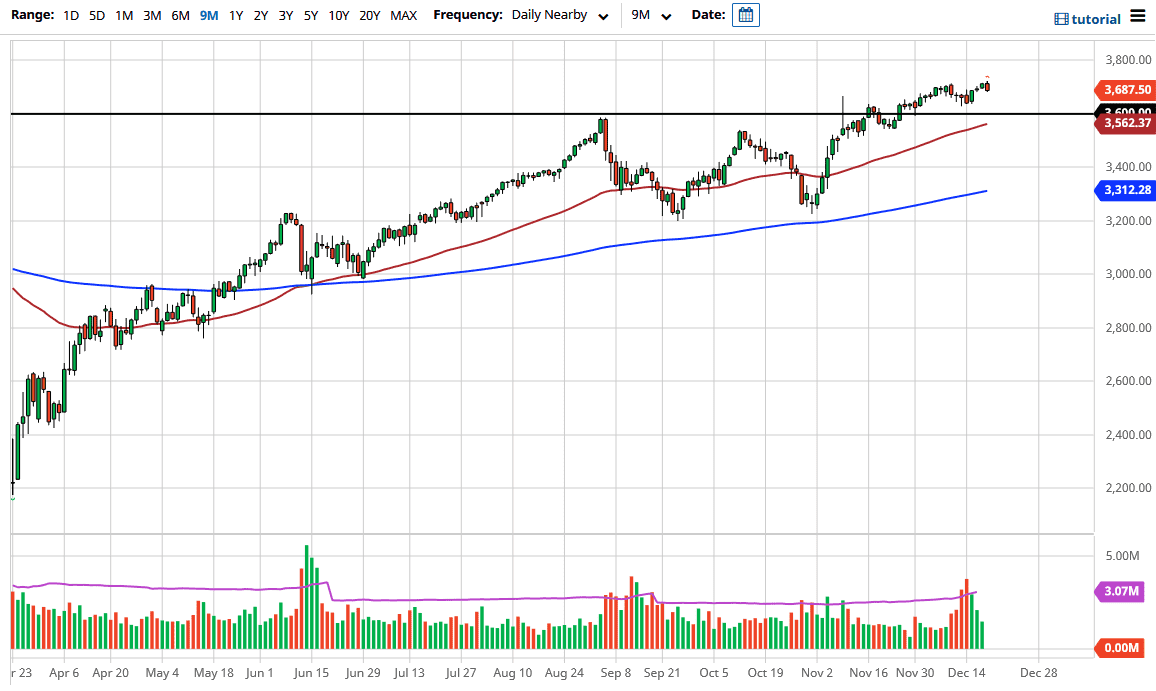

The S&P 500 pulled back during the trading session on Friday, which was due to “quad witching” in the United States, meaning that four different options classes expired on the same day, so mass chaos was of course going to be a major issue. The size of the candlestick is not that big of a deal, due to the fact that there were all kinds of forced rebalancing in portfolios as well, so I would not read too much into the Friday session.

Furthermore, over the next several days, there will not be much of a reason to trade, because this is a market that continues to see more of a choppy attitude going into the holidays. As liquidity shrinks, it is almost certain that we will see noise become a factor as well, as the volatility will pick up on the occasional large order. Do not be fooled into thinking that the market is suddenly going to fall apart, unless you see a complete misstep by Congress when it comes to stimulus. At this point, it certainly looks as if they will do something, so I would give that about a 10% chance.

To the upside, the market will go looking towards the 3800 level given enough time, and ultimately, I think we will go above there, perhaps all the way to the 4000 level. This is based on the consolidation underneath that had been a 400-point region. Extrapolating that from the 3600 level suggests that we could get to that 4000 handle. I do not think it will happen in the short term, but given enough time I think we will hit that level, perhaps sometime early next year. Short-term pullbacks will continue to be bought into, because the S&P 500 will be lifted either by Congress or the Federal Reserve, if it is needed. Pay attention to the US dollar; if it starts to sell off drastically, that could also help the S&P 500 as traders look at a cheaper US dollar as a good sign of economic strength due to exports. Yes, I know it is moronic, but it is actually the way they think about it. I have no interest in shorting this market, as it is simply in a strong uptrend.