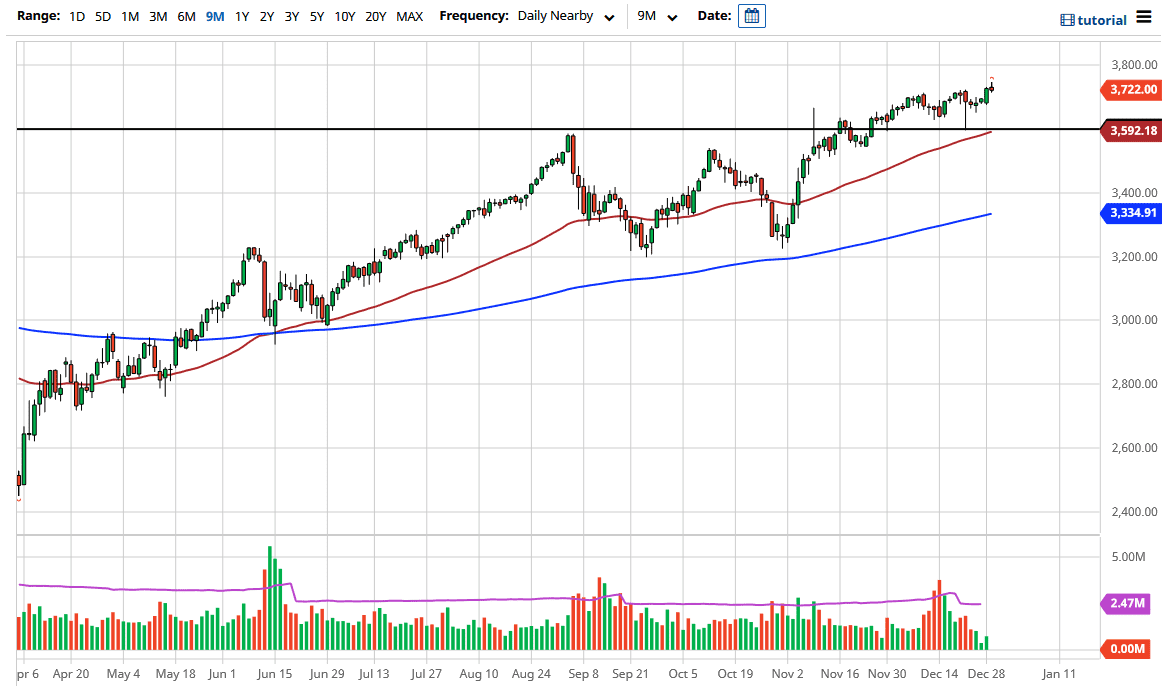

The S&P 500 initially tried to rally during the session on Tuesday, but then turned around to form a shooting star. This suggests that we are running into exhaustion, but we are still very much in an uptrend, so we may get an opportunity to pick up a little bit of value.

One of the biggest drivers of stocks going higher recently has been the idea of stimulus, as it has passed. However, during the trading session on Tuesday, there were a lot of headlines that got the markets thrown around the place due to the fact that we had less than usual volume, which means that reactions may have been overdone. Initially, the US House of Representatives passed a bill to raise the stimulus direct payment to Americans from $600 to a level of $2000, putting pressure on the U.S. Senate to match the same level. As we continue to see a lot of anger in the United States due to all of the pork that was thrown in the stimulus bill, one cannot assume that the U.S. Senate will pass it right away. However, Senate Majority Leader McConnell decided to put the kibosh on that, so it needs to be voted upon in what would be a much more difficult scenario as opposed to unanimous consent when they just simply need enough people to agree to it audibly. At this point, we would need something like 12 Republican senators to flip sides and agree with this.

The 3600 level underneath should offer plenty of support though, due to the fact that the 50-day EMA is sitting there. One would think that, politically speaking, with the Georgia Senate runoff races coming next week, the Republicans are essentially stuck with the idea of passing stimulus. In other words, I think it is only a matter of time before value hunters come back in order to take advantage of any dip in this market, as we have seen such a strong uptrend. Furthermore, it is worth noting that we had recently broken out of a 400-point range, and extrapolating that from the top of the range leads for a move towards the 4000 level above.