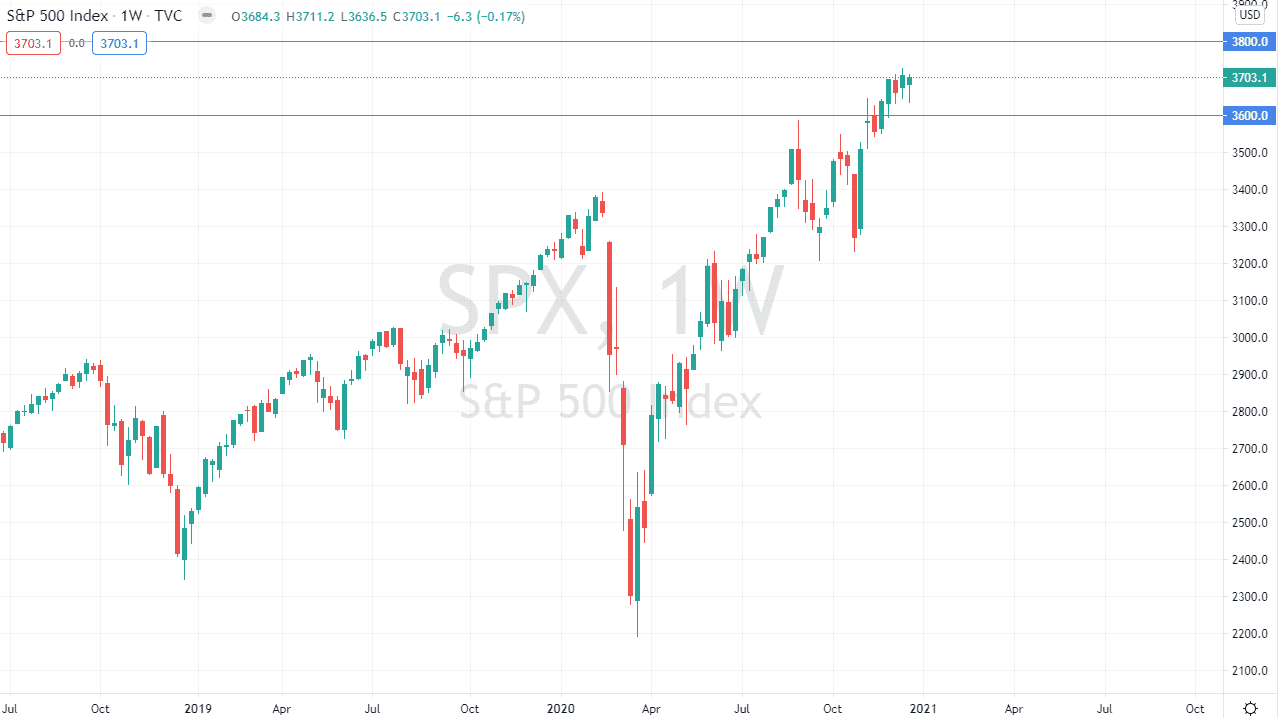

The S&P 500 was somewhat sideways over the course of December, and part of that was the hesitancy to jump in with both feet given how stimulus has been held up. The market is likely to see a bit of confusion late in the year and into the beginning of year, but it is in a strong uptrend and that has not changed, despite the fact that we have essentially gone sideways for a while. The market is simply trying to digest some of those massive gains heading into the end of the year.

The 3600 level has offered a bit of support, just as has the 3500 level. I suspect that we may get a short-term pullback into that general vicinity, unless something ugly happens. If something a little uglier happens along the lines of stimulus being held out, then we could see the S&P 500 drop towards the 3200 level where I think there is even more interest in going long. The one thing that we have learned over the last 13 years or so is that you simply do not short indices. Yes, you can make money to the downside, but it is so much easier to simply play the longer-term uptrend in which the markets have been.

Keep in mind that stimulus continues to be a main driver of stock markets, and not necessarily anything along the lines of earnings. Yes, they can make things a bit more interesting for traders, but at the end of the day it is all about the order flow. Money tends to flow into a handful of major stocks, and with the coronavirus fears still out there causing issues as we continue to see mutations, the early part of next year will continue to see the same general theme. This will continue to be the case at least until we get past the coronavirus issues, which I believe will last much longer than people anticipated. It is not necessarily that I think people are going to suddenly see massive spikes in death rates, just that behavior has certainly changed. Economies around the world locking down will make things very choppy, but the ability of Wall Street to look past all of the negativity should never be ignored. I anticipate we may get a short-term pullback, followed by more buying later in the month.