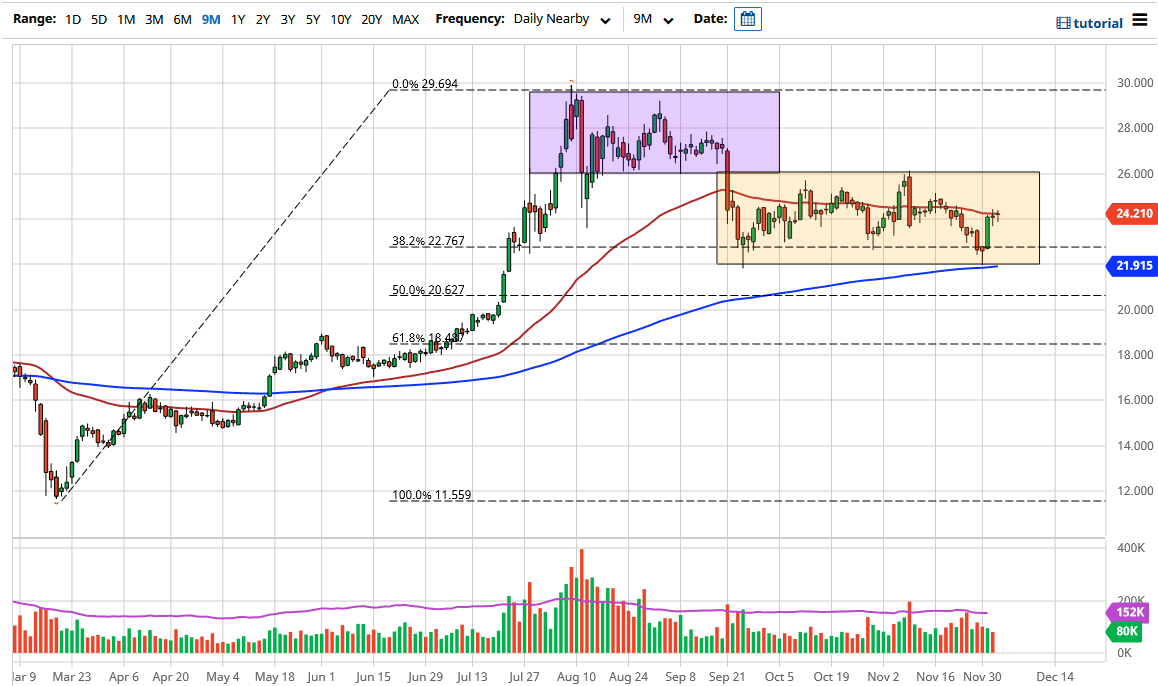

The silver market went back and forth during the trading session on Thursday, as we continue to dance around the 50 day EMA. This is an indicator that a lot of people pay attention to, but it should be noted that the 50 day EMA is relatively flat. Because of this, we have chopped back and forth through that level multiple times, showing signs that we are essentially continuing to consolidate, and as we head into the Non-Farm Payroll announcement on Friday. Ultimately, that will probably make a move in the US dollar, which could of course help give some type of directionality to silver, but I think one thing is for sure at this point in time, we see plenty of support underneath based upon the massive move on Wednesday.

The 200 day EMA sits just below the $22 level, where we had formed a bit of a hammer from the Monday session, and it suggests that we started to see longer-term traders coming into the picture to take advantage of what should be “cheap silver.” Furthermore, the US dollar is likely to be very soft going forward and that should continue to push the precious metals markets higher. That being said, the last couple of days has shown a couple of different things due to the fact that we had not only rallied to reach towards the 50 day EMA and then simply go sideways. This shows that the market at least is somewhat comfortable in this area, so imminent selling is not necessarily going to be a major concern.

At this point in time, the market is likely to send buying pressure back into the market, or perhaps breaking above the top of the candlestick from Tuesday to send it much higher. The $26 level above is going to be a target, having said that, the market does break above the $26 level, it is likely that it will go looking towards the $20 level. All things being equal, I think that short-term pullbacks continue to be buying opportunities and that is exactly how you should look at this market. After we get through the jobs number, we will see what happens with the US dollar, and if it falls then that is yet another reason to think that silver goes to the upside.