The silver markets fluctuated during the trading session on Thursday as we continue to see a lot of back and forth. What is interesting is that we are starting to get a bit more in the way of bullish pressure, as we are settling around the $24 level. If we can break above the top of the range for the trading session on Thursday, then we will probably go looking to test the $25 level yet again. That is obviously a large, round, psychologically significant number, but it is also a number that we have sliced through more than once.

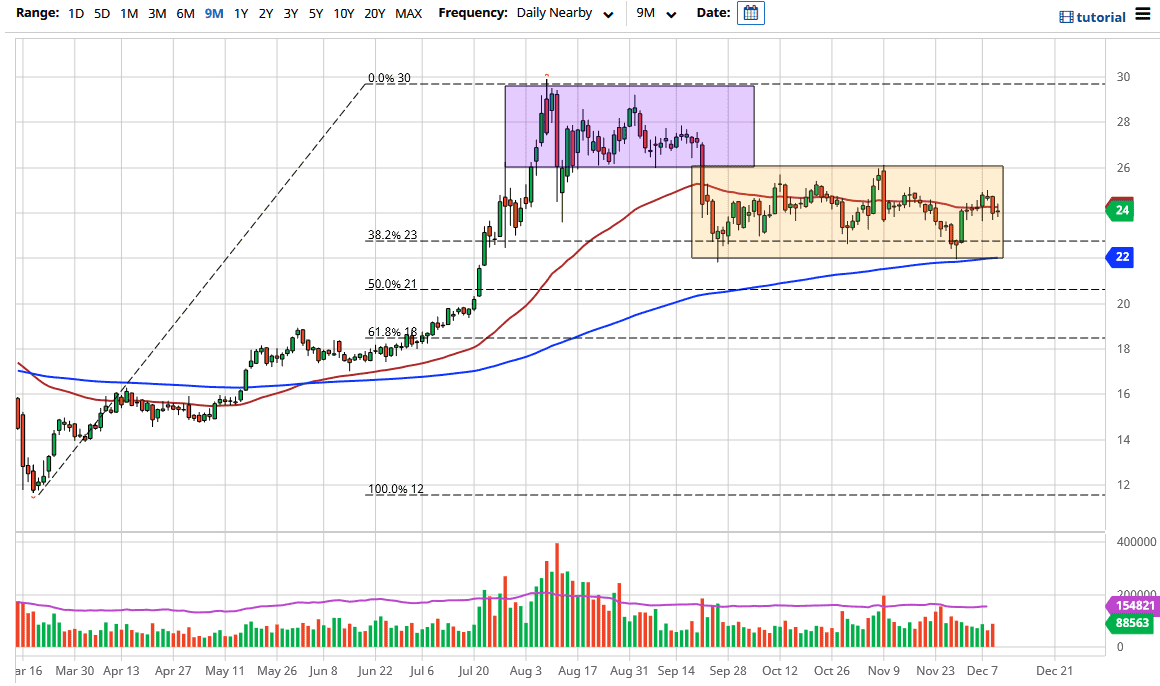

When I look at the charts, I see a rather obvious consolidation area between the $22 level and the $26 level. The $22 level is not only supportive, but it also has seen the 200-day EMA pop up and supported that general vicinity right as we formed a nice-looking hammer last week. We have formed a floor in the market, so the buyers will return time and time again, as we are looking at a significant amount of stimulus coming down the road in the United States, thereby pushing the value of the US dollar lower.

The Australian dollar has broken out above the 0.75 handle, and while it is not directly correlated to this market, it shows just how soft the US dollar has gotten. This should eventually send this market higher, as the US Dollar Index has been testing major lows. If we do break down further, it is likely that traders will go looking towards precious metals such as silver in order to protect wealth.

Pay attention to the $26 level above, because if we break above there it is likely that the market will go looking towards the $27 level, possibly the $28 level after that. Longer term, I believe we are going to go looking towards the $30 level, an area from which we have drifted lower. Nonetheless, when you look at the weekly chart, it puts a lot of this into perspective; we are simply trying to digest the massive amount of gains that this market had seen earlier this year. I have no interest in shorting silver anytime soon.