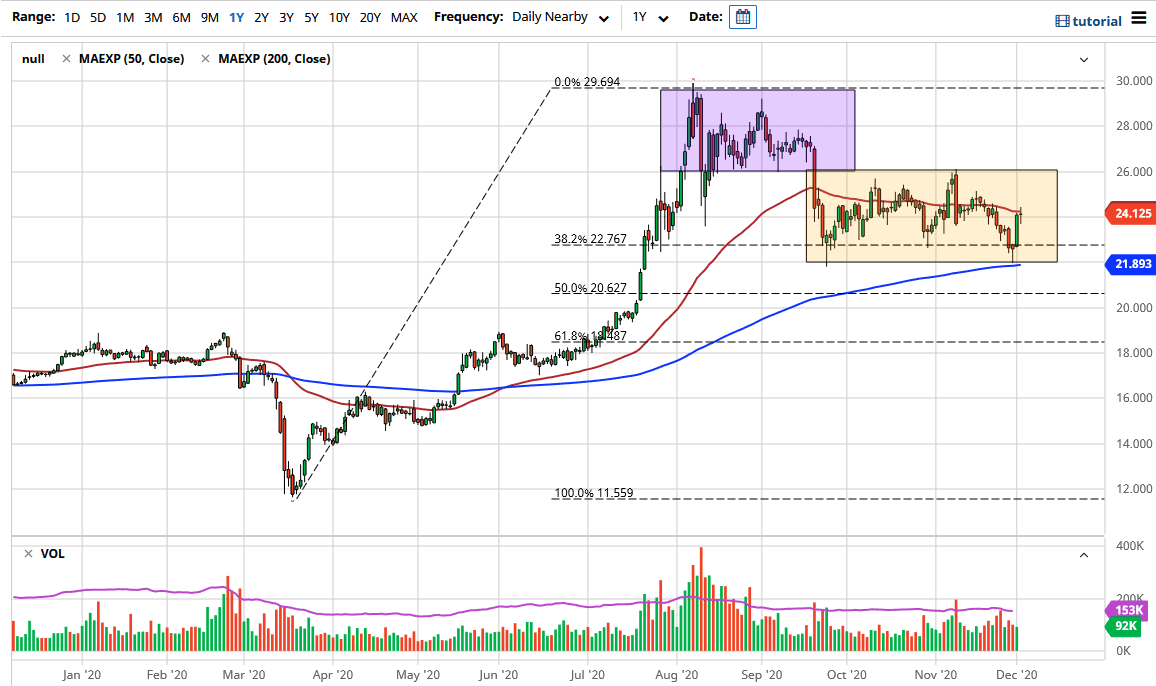

The silver markets fluctuated during the trading session on Wednesday, as we reached the psychologically and crucial 50-day EMA indicator. We are also sitting at the $24 level, so it follows that we would see the markets take a bit of a breather. Furthermore, it should be noted that after the massive gains, a lot of people will be trying to digest those massive moves. After all, it is not every day that the silver markets rally 7%.

It is worth paying attention to the US dollar, as it is getting smoked against several currencies right now. That should continue to put upward pressure on precious metals in general, as it is a way to hedge against the US dollar falling apart. The breakdown that we have seen in the US Dollar Index recently has been a major trendline break from the last several years, so people will be trying to get away from the US dollar as it gives them a way to protect their wealth.

People are banking on the “post coronavirus economy”, which suggests that the market is going to look for the reflation trade, and that will drive precious metals higher. But the silver market also has a significant amount of influence due to potential industrial demand. It looks as if pullbacks will be bought, as the 200-day EMA has offered support, touching just below the hammer that kicked things off on Monday.

The 200-day EMA is an indicator that you should be watching. I like the idea of buying short-term dips every time we get an opportunity, as I believe that the silver market is initially going to try to make a push towards the $26 level, and then the highs at the $30 level. I have no interest in shorting silver anytime soon, because it looks so bullish and we have recently seen a major shot higher. The type of spike that we have seen to the $30 level does not simply just disappear.