Silver markets initially tried to rally during the trading session on Wednesday as we await results of stimulus talks and the Federal Reserve meeting during the trading session. The Federal Reserve decided to continue keeping the monetary policy loose, and although initially the US dollar picked up gains, traders turned around and sold the dollar as they almost certainly are starting to focus on stimulus again. It looks like we will see stimulus coming, and when it does, it is likely that the US dollar will also be sold at that point as well.

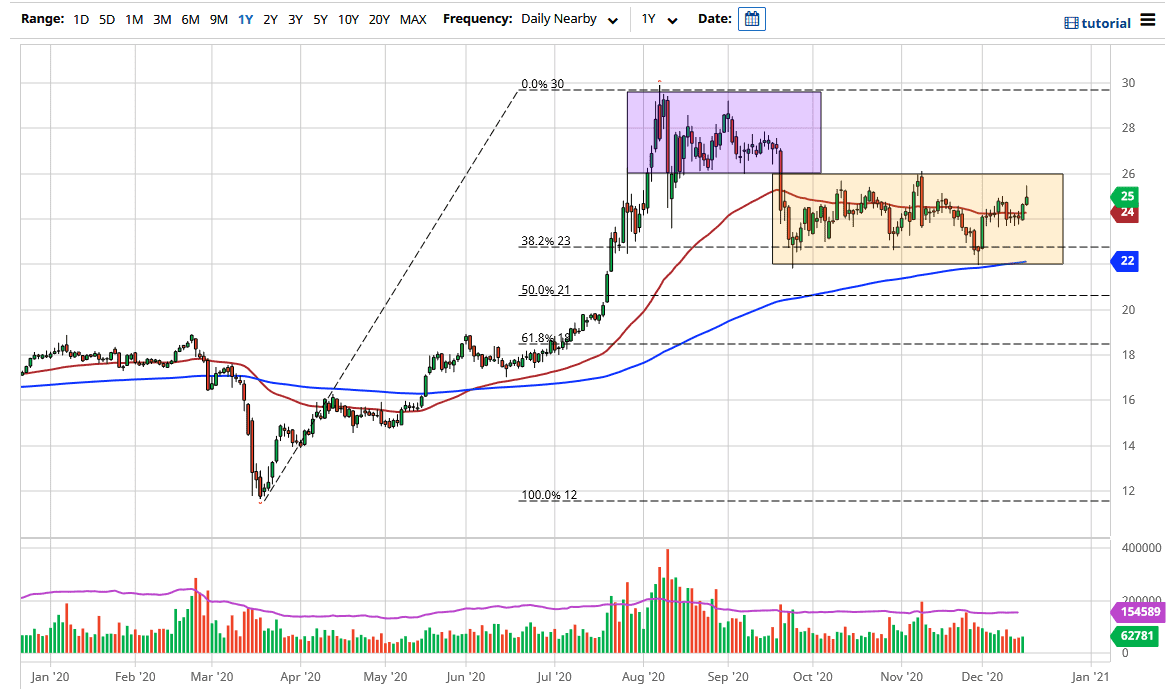

Another thing that stimulus could bring about is a demand for silver, as it is an industrial metal. We will see an attempt to break towards the $26 level, and eventually even break above there. If we do, then the market will probably go looking towards the $28 level, followed by the $30 level. The argument about inflation is probably a bit stretched, but the fact that the US dollar is losing value will naturally provide a bit of a boost for most commodities. Market participants continue to see a bit of a basing pattern, so we will continue to see people trying to get involved and eventually break to the highs yet again. I have no interest in shorting silver, but the market will continue to see a lot of volatility.

As we head into the holidays, volatility could pick up due to the fact that volume will drop, but it is clear that the buyers are starting to flex their muscles and take control of the market. Looking at the chart, you can see that I have two clear boxes laid out, and we are simply trying to move from one to another. To the downside, the $22 level should offer support, not only due to the fact that we have seen a bit of a “double bottom” at that level, but also because of the 200-day EMA which many people will be watching. At this point, I am a buyer of dips.