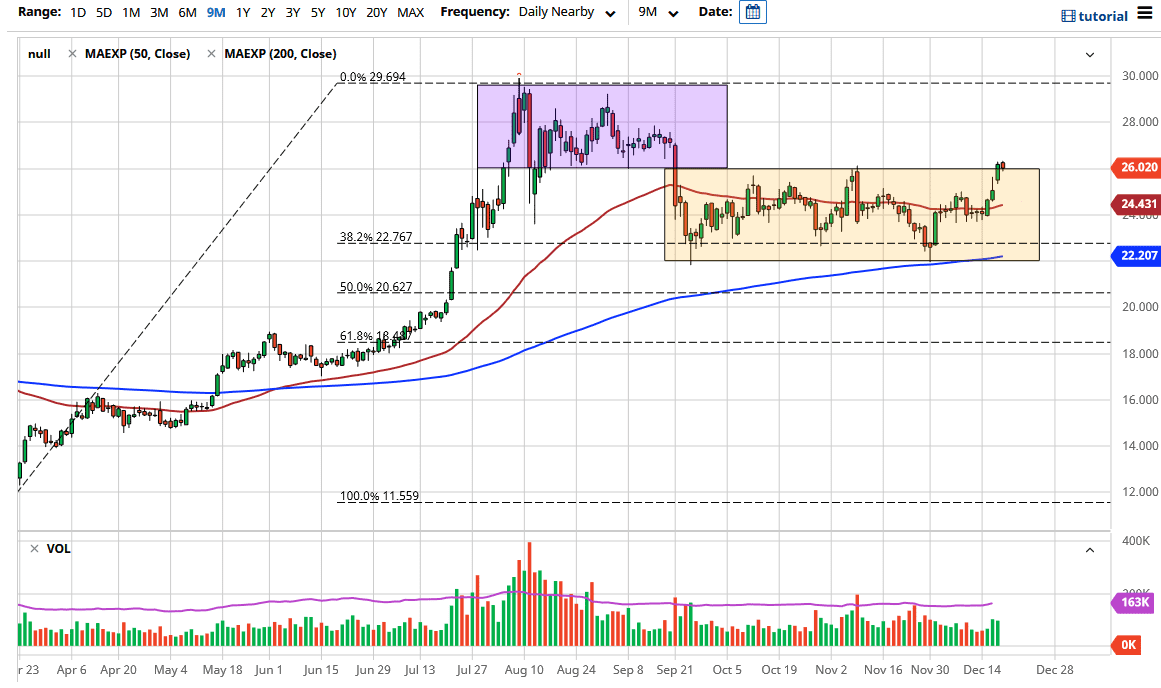

Silver markets fluctuated during the trading session in a mostly negative candlestick for the day. We are sitting just above the $26 level, which is a fairly important figure based on the previous consolidation. It is only a matter of time before we break out to the upside and go looking towards the $30 level, especially if Congress does in fact approve stimulus like it looks at the moment. At the time of this writing, Congress is meeting and jawboning back and forth, but it does look like they are trying to make some progress.

To the downside, I see a gap at the $25 level that comes into play, meaning that we will probably continue to see support in that area as well. Furthermore, the $25 level attracts a certain amount of attention due to the fact that it is a round number. The 50-day EMA sits just below there, right at the $24.43 level, so that is also going to be supportive.

When you look at the yellow box on the chart, it is easy to see that we have been trying to form a basing pattern for the last several months. We are looking at the possibility of a move to the upside in a much bigger fashion, but it is going to take a certain amount of wherewithal to hang on to the volatility. It is more than likely going to be very difficult to trade over the next several sessions as people are more focused on Christmas than they are anything else.

With all that in the background, we are looking at a move towards the $30 level in this market, but we could even break above there if we see enough US dollar selling. The next couple of weeks are going to be very interesting once the liquidity comes back, as we are on the precipice of breaking down the US Dollar Index, which will have a huge negative correlation to this market. The US dollar did rally a bit during the day on Friday, but I would not read too much into that other than it was probably a significant amount of profit-taking.