Silver markets rallied significantly during the trading session on Tuesday, reaching towards the 50-day EMA. This is a market that looks like it has turned around completely, and we are going to see a move much higher. Looking at the size of this candlestick, there will be a bit of follow through, so I look at pullbacks at this point as a nice buying opportunity.

The main driver of silver going higher during the trading session is the fact that the US dollar got absolutely pummeled. In fact, the EUR/USD pair has finally left the 1.20 level underneath and beyond, and it looks like we are going to continue to look towards the pair as a sign of where the US dollar is going. As the silver market is priced in US dollars, it follows that we would continue to see silver and other commodities go much higher.

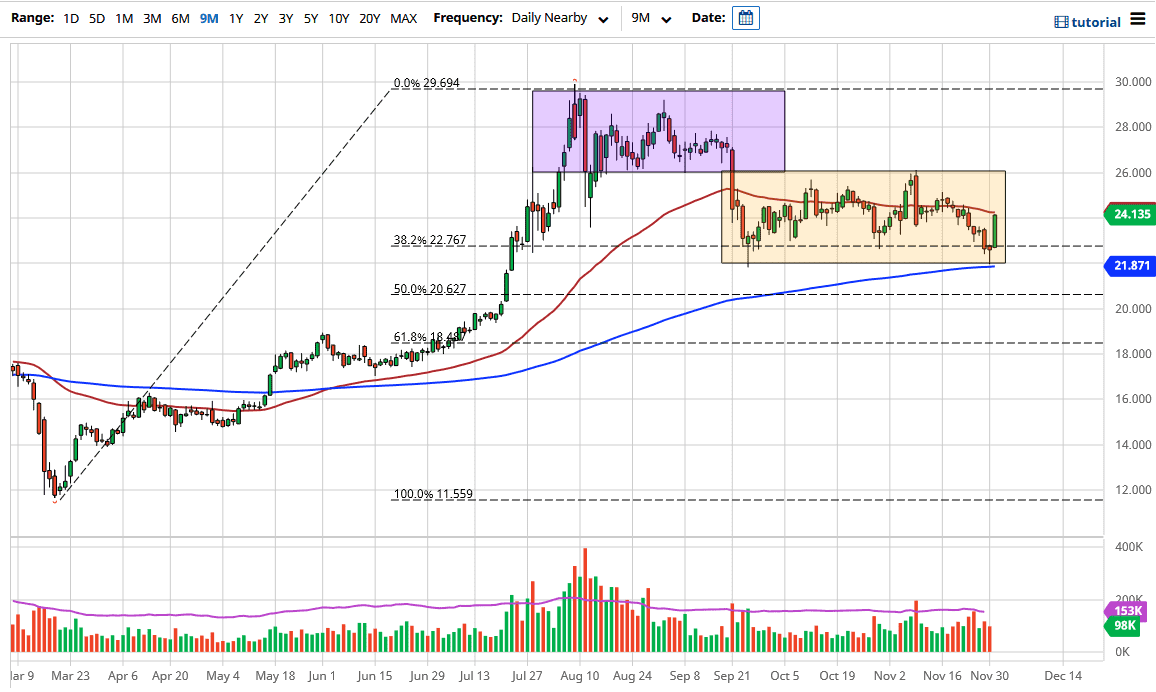

Silver has more momentum than gold does typically, and that was most certainly the case during the trading session on Tuesday. Although gold was very strong, silver gained almost 7% by the end of the day. Now that the US dollar is finally falling significantly, we could see a massive move higher. Buying dips will almost certainly be the way going forward at this point as the market has shown itself to be resilient, and it should continue to see a lot of momentum coming back into the market as we had sold off for some time. In fact, you can make a serious argument for a double bottom having just happened, so this market should continue to go much higher. I believe that the $26 level will probably be targeted initially, followed by the $30 level again. With more stimulus coming out the United States, there is a really good chance that precious metals will continue to see inflows.

The 200-day EMA offering support is a good sign for longer-term traders, so I anticipate that more money will be flowing into the market given enough time. Shorting at this point in time is all but impossible, even though I had not thought much about it over the last couple of months.