Silver markets fell almost immediately during the trading session on Wednesday to break down below the 50-day EMA again. This is due to US dollar strength in an overextended market when it comes to the greenback. It follows, then, that we had seen a bit of a recovery by the US dollar, especially as people are not entirely sure what to do with themselves right now. We continue to see concerns about stimulus getting passed and some of that stimulus bet probably is coming off the table. As long as that nonsense between Pelosi and McConnell persists, itwe will continue to see a lot of noise when it comes to the US dollar and risk appetite in general. Remember, these are politicians, who are generally not unlike children.

The reflation trade seems to be on pause, at least for a single session. It is finally pulling back, so many value hunters will probably come back into the market and try to take advantage of “cheap silver.” The market will eventually find a reason to go higher, if for no other reason than stimulus finally getting passed or a rumor that makes it sound likely.

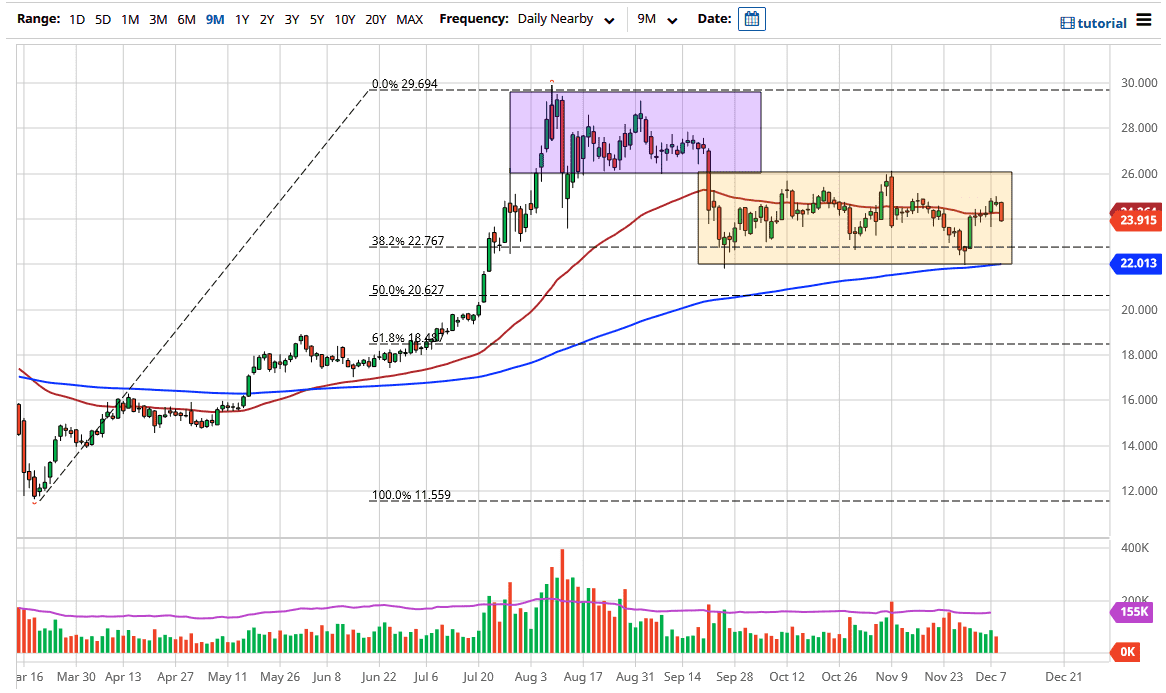

We have been building a large base for some time now, so it is worth paying attention to the possibility that we are simply going through the motions yet again. The 200-day EMA sits down at the $22 level, and that would be an excellent opportunity if we do indeed get down there. I suspect that we will not, simply because so many people have been caught offsides with this trade. Furthermore, it is worth paying attention to gold because it does have an influence on this market as well, so you cannot ignore what happens in that market. This is all about the US dollar and really nothing else once you measure out the correlations, so pay attention to the US Dollar Index. If it falls, silver should rise and vice-versa. It is worth noting that the “risk off" trade during the trading session was not necessarily a disorderly move, so it should provide opportunities.