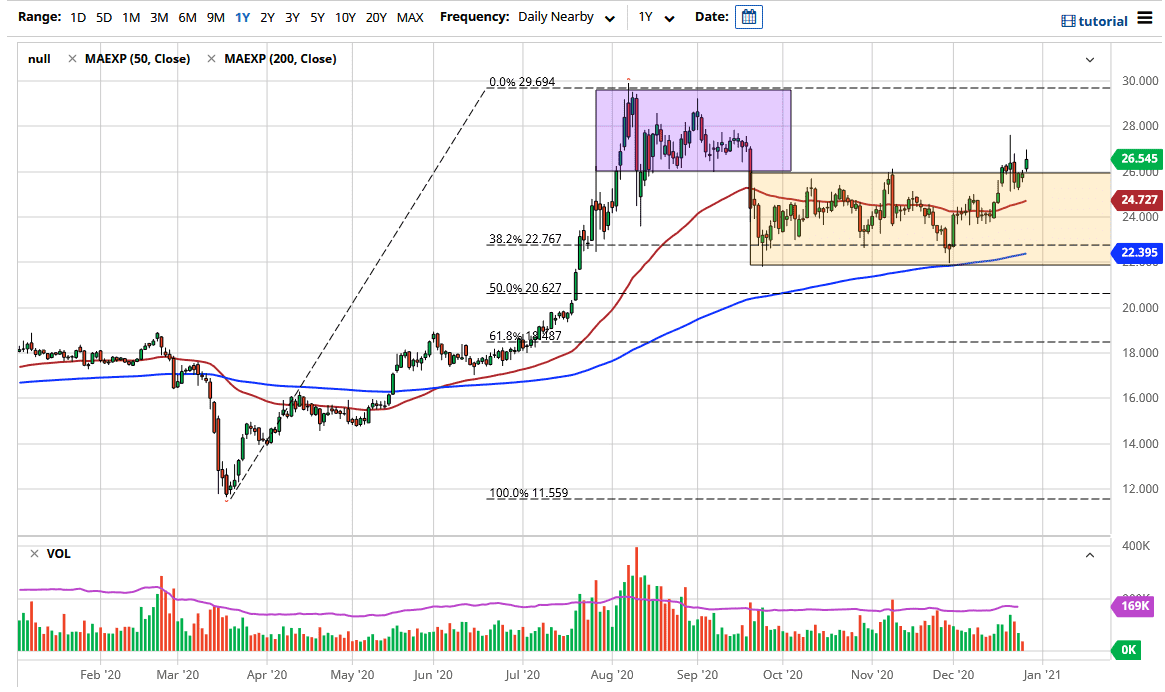

The silver market has broken above the $26 level during thin trading on Monday as traders came back to work after Christmas. The week between Christmas and New Year’s Day tends to be very thin, so I would not read too much into the price action other than the fact that it is a continuation of the buying that has been such a major theme of the market. The US dollar has been losing value, and that tends to send the precious metals markets higher over the longer term, as it looks like we are trying to test serious supply just above.

The supply area is the $27 level, extending to the $28 level. We will eventually break above there, but we need to see the US dollar break down. The 50-day EMA underneath has offered a significant amount of support more than once and is sitting just below the psychologically important $25 level. The 50-day EMA is starting to turn higher, suggesting that we are going to continue to see short-term momentum reach to the upside. I do think that will happen, but we may have a bit of work to do over the next week or so in order to build up the necessary momentum. If we were to break down below the 50-day EMA, then we could go looking towards the $24 level underneath. Underneath there, the 200-day EMA sits at the $22.93 level, and is also starting to trend higher as well. In other words, it is only a matter of time before silver rises.

It is worth noting that the volume over the last week or so has been very thin, so you can only read so much into the market movement. The overall trend of the market is higher, so it makes sense that we would see buyers on these dips, and that we will eventually try to get towards the $30 level. It will take several weeks to get there in my estimation, but it does seem to be where we are going over the longer term. As far as selling is concerned, I do not have any interest in doing so.