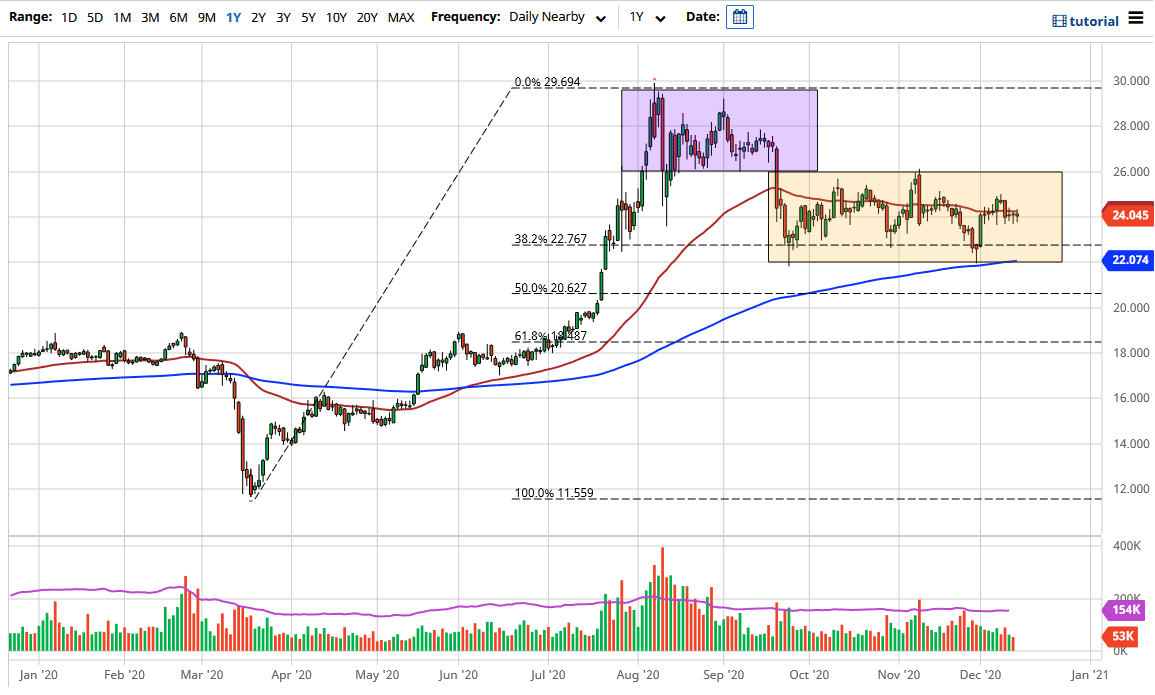

Silver markets fell during the trading session on Monday to kick off the week, but as you can see, we continue to see support just below the $24 level as we have over the last several sessions. The silver markets are moving on the idea of more stimulus coming out the United States, which will drive up the demand for commodities in general. This is not to mention the fact that silver has a major industrial component built into it, meaning that if we have industry taking off, the demand for silver will skyrocket.

Beyond that, the loosening of monetary policy and fiat destruction should continue to boost silver in general. It is likely that we will continue to see a lot of buyers on dips, looking towards the $22 level where the 200-day EMA sits. Because of this, I have no interest whatsoever in trying to short silver. If we break down below the $22 level, silver could really start to take off towards the $20 level where I think there would be even more demand. However, silver could become a hedge against inflation if stimulus gets out of control which, if given half a chance, they will do in the United States.

To the upside, I see the $26 level as a significant target. If we can break above there then we will go looking towards the $28 level. The $30 level will be the target but it will probably take some time to get there. In that case, you have more of a general grind higher more than anything else. So, you are simply buying silver and hanging onto the trade with the understanding that it will be noisy. I have no interest whatsoever in trying to short this market, and I look at this as more of an investment and less of a trade. Pay attention to the US dollar, as it does have a strong negative correlation to the silver markets.