Unlike most of its developed counterparts, New Zealand has control over the COVID-19 pandemic, similar to Singapore. The island nation of just over 5,000,000 has only 72 active cases and reports single digits in newly confirmed infections. Its export-oriented economy does suffer from depressed global demand while the government struggles to forge a path forward. The NZD/USD remains vulnerable to a profit-taking sell-off inside its resistance zone amid a lack of bullishness.

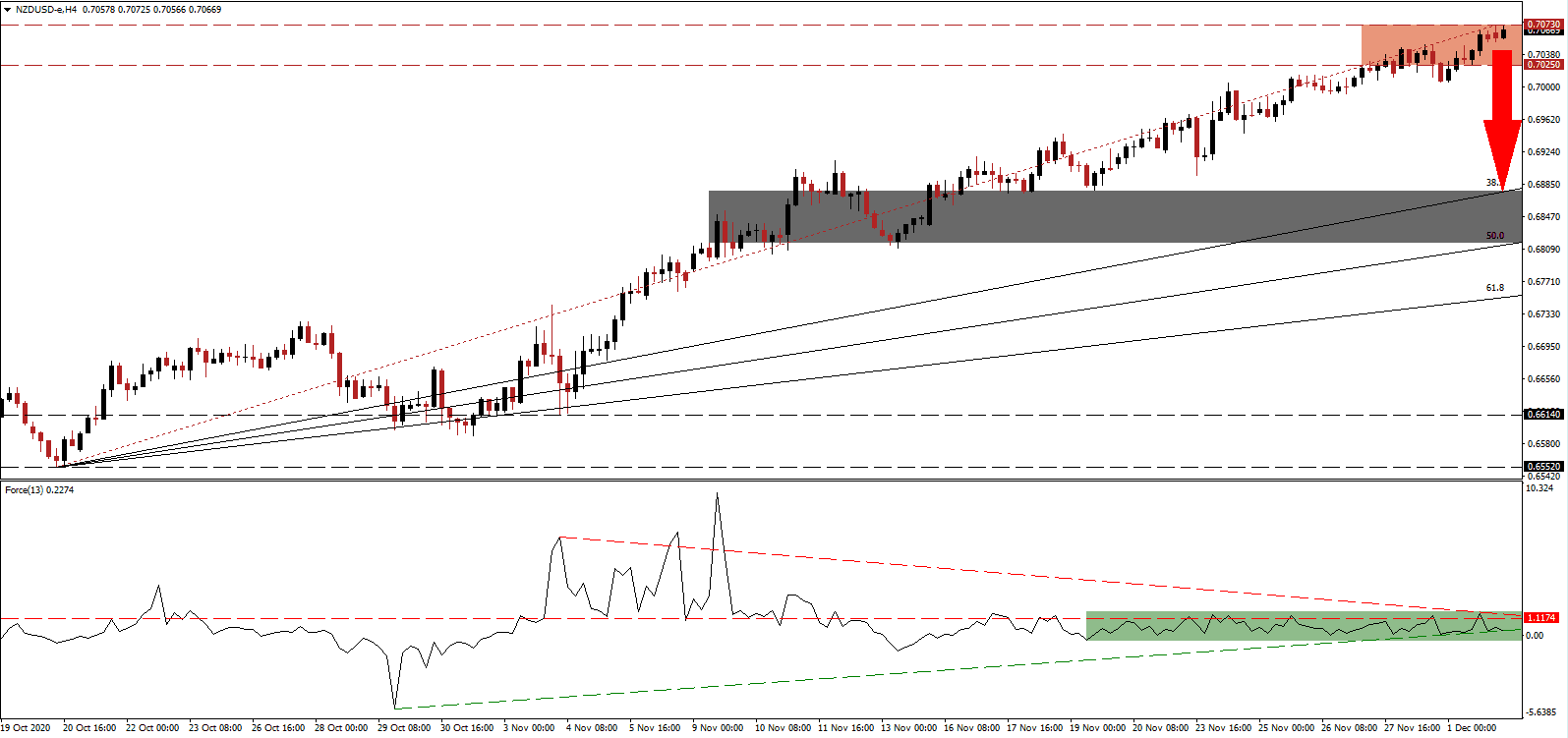

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level, while the descending resistance level adds to bearish progress. A pending contraction below its ascending support level, as marked by the green rectangle, will magnify breakdown pressures. Bears wait for this technical indicator to slide below the 0 center-line to regain complete control over the NZD/USD.

Expectations for the Reserve Bank of New Zealand (RBNZ) to deliver more interest rate cuts in 2021 dampen the outlook for the economy and the currency. While the central bank may be less dovish than previously announced, two 25 basis point reductions remain on the table. It will take interest rates to -0.25%. The NZD/USD is well-positioned to accelerate below its resistance zone located between 0.7025 and 0.7073, as identified by the red rectangle.

New Zealand exports dropped 4.4% in October year-over-year, and imports plunged 13.0%, pushing the annual trade surplus to a 28-year peak of NZ$2.2 billion. It confirms the slowdown in global and domestic demand, but third-quarter retail sales clocked in above estimates. A breakdown in the NZD/USD can take it into its short-term support zone between 0.6816 and 0.6878, as marked by the grey rectangle. The ascending 50.0 Fibonacci Retracement Fan Support Level enforces it.

NZD/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.7070

Take Profit @ 0.6870

Stop Loss @ 0.7120

Downside Potential: 200 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 4.00

A breakout in the Force Index above its descending resistance level can extend the advance in the NZD/USD. While the bearish outlook for the US dollar persists, the long-term bullishness for this currency pair remains. The next resistance zone awaits between 0.7175 and 0.7236. Forex traders should anticipate an increase in volatility moving forward.

NZD/USD Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 0.7150

Take Profit @ 0.7225

Stop Loss @ 0.7120

Upside Potential: 75 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.50