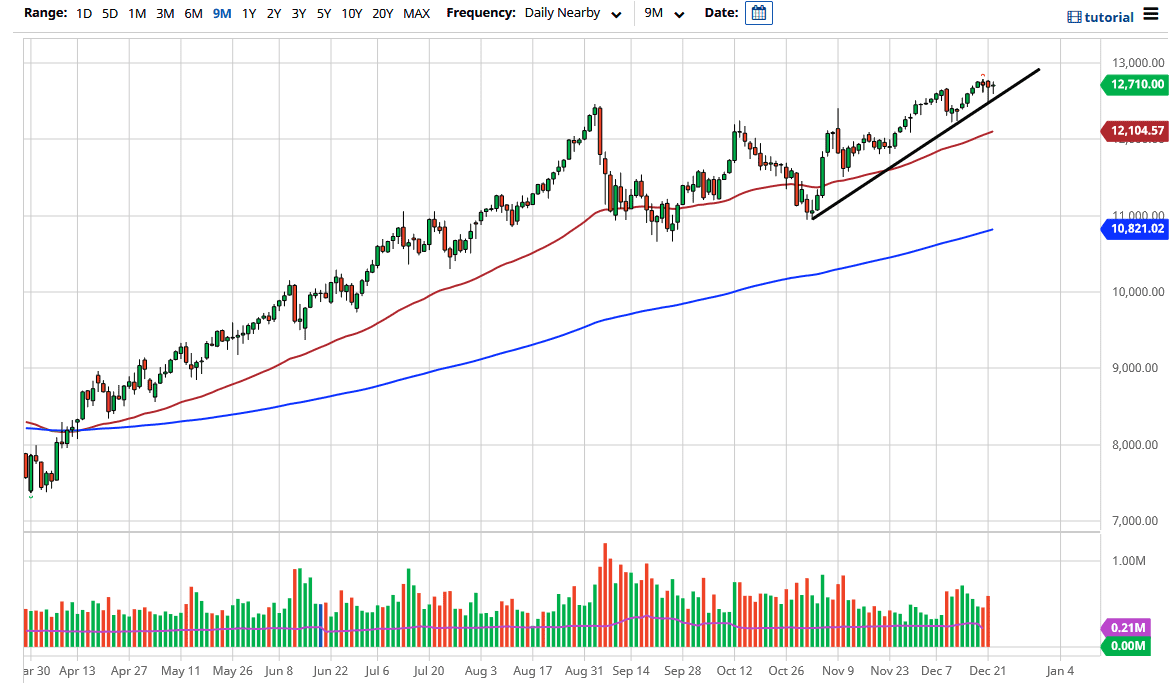

The NASDAQ 100 pulled back during the trading session on Tuesday as we continue to see a bit of malaise heading into the end of the year. We are still very much in an uptrend, so it is worth paying attention to the short-term pullbacks that can come into play. That offers value in a market that is obviously bullish overall. The uptrend line should also come into play, and with that, plenty of buyers underneath. Nonetheless, you should keep in mind that we are at the end of the year, so liquidity could be an issue. If the market were to break down, I would simply stay on the sidelines and wait for an opportunity to get long again. There are multiple areas underneath that should continue to offer support, especially near the 12,100 level. After that, we could see the 11,000 level come into play, but I suspect that is very unlikely to even be reached.

We have recently broken out of a significant consolidation area, which should send this market looking towards the 13,000 level, possibly even the 14,000 level after that. I have no interest whatsoever in shorting this market, as NASDAQ 100 main stocks continue to be favorites of traders; not only for the growth that you see in the companies, but also the so-called “stay-at-home trade” that so many of the major companies out there attach themselves.

With a lack of liquidity, we could see a significant break down, but that should only offer value heading into the new year. At the beginning of the year, we will see traders try to pick up stocks to open up their portfolios for the year, which continues to be a driving influence on where we go to the upside. If we were to break down from here, that only offers a nice opportunity, especially if the US dollar starts to sell off because then risk appetite will start to pick up again. The candlestick for the day is lackluster at best, so I would not be overly concerned about the fact that it was such a tight range, as there is lack of interest at the moment.