The NASDAQ 100 shot higher during the trading session on Monday as we continue to see buying pressure in general. With the stimulus bill signed over the weekend, it suggests that the cheap money should continue to flow into the market, as the biggest beneficiary will be that the unemployment benefits will extend, meaning that American consumers can continue to buy things. That is 70% of the economy, and therefore stocks will rise.

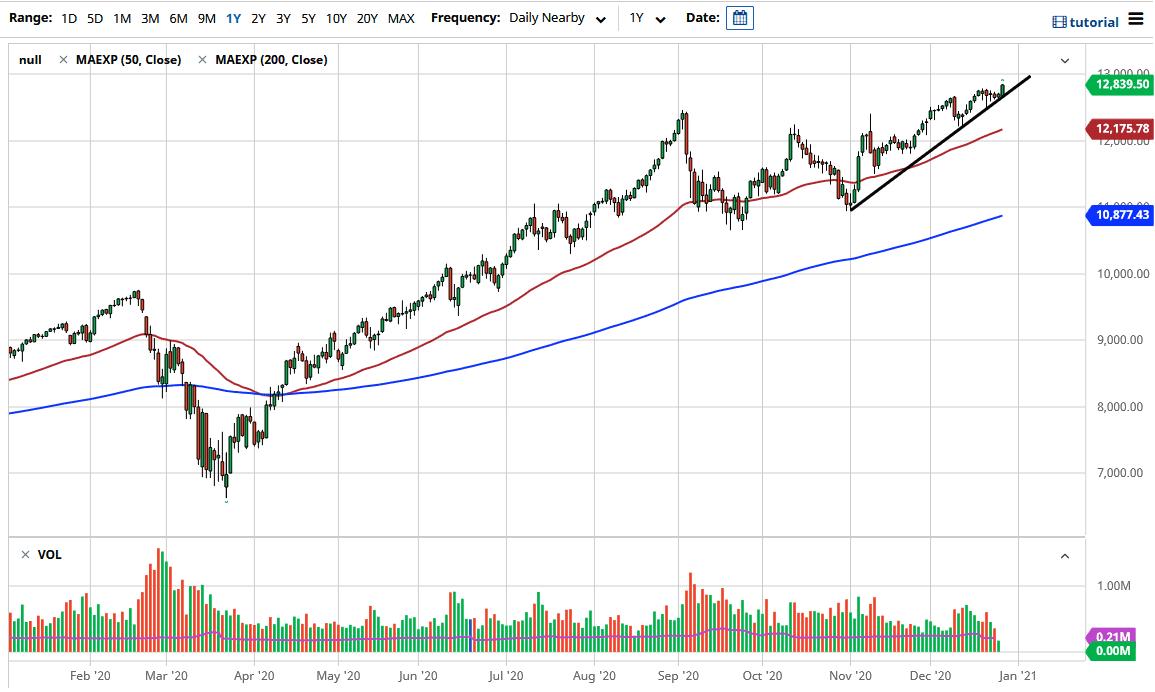

The 13,000 level above should be a significant resistance barrier based upon psychology more than anything else, but I do think that we will go much higher. The uptrend line that I have marked on the chart has shown itself to be relevant, so I continue to pay close attention to it. Even if we break down below that uptrend line, then the 50-day EMA at the 12,175 level is also an area that I think many people will watch. Longer term, I believe that the NASDAQ 100 will go looking towards the 14,000 level. That is a story for 2021, but the one thing that is obvious is that this market will not fall for any significant amount of time. We had recently broken out of consolidation near the 14500 level, from the 1500-point range. That is where I get the “measured move” of 14,000 as a target.

The “stay-at-home” trade is probably going to continue to show signs of life again, meaning that the coronavirus continues to throw money at a handful of companies such as Amazon, Microsoft, and others that allow for productivity from home. I have no interest in shorting this market, because anytime you try to short the NASDAQ 100 it seems like playing with fire. I believe that the 12,000 level will also be significant support, so pullbacks are to be thought of as value and opportunities of which you can take advantage. However, it should be noted that typically between Christmas and New Year’s Day there seems to be a proclivity to go higher, known as the “Santa Claus rally.” We are in an uptrend and there is no need to overcomplicate this, so I find only one direction appealing.