After five consecutive bearish trading sessions, the price of gold was pushed to the support level at $1818 an ounce. Since the beginning of today's trading, the yellow metal has been trying to rebound higher. The price stabilized around $1840 an ounce at the time of this writing, awaiting stronger incentives to complete the upward correction instead of collapsing below the $1800 psychological support. The USD decline had an important role in stopping the recent losses of gold, which came with the support of investors' risk appetite after the start of the global vaccination against the coronavirus, which gave good hopes for the future of the global economy in the year 2021. Despite the recent performance of gold, silver futures contracts for the month of March ended lower at $24.047 an ounce, while copper futures settled at $35.265 a pound.

According to reports, the United States started giving COVID-19 vaccines, with hospitals giving priority to front-line healthcare workers. This comes after the Center for Disease Control and Prevention approved the COVID-19 vaccine from Pfizer-BioNTech. CDC Director Robert Redfield accepted the Prevention Advisory Committee's recommendation on immunization practices using Pfizer-BioNTech's COVID-19 vaccine in people of 16 years of age or older.

The recommendation comes after the emergency use of the vaccine was approved by the US Food and Drug Administration last Friday.

Investors are also looking forward to the upcoming monetary policy meetings of the US Federal Reserve Board, the Bank of England and the Swiss central bank, as well as the Japanese central bank.

The Brexit file also affects investor sentiment and consequently the yellow metal. British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen agreed at the end of the week to extend negotiations, leading markets to see increased odds for a deal. The press quoted Michel Barnier, chief EU negotiator, as saying that in the event of a breach in the fisheries, an agreement could be struck as soon as this week, but alternative readings of the situation indicate that the talks could continue until the end of the year.

Therefore, the British pound is expected to regain the gains it lost against the euro, the dollar and other major currencies in recent days, provided that the chances of reaching a deal before the end of the year continue to rise. In this regard, the Telegraph reported on Monday that a source from British Prime Minister Johnson's office said that while Johnson's visit to Brussels last week failed to make any progress, the mood has changed over the weekend, as the European Union is now "dealing" with "problems". EU sources told the same newspaper that member states are taking a firm stand, but there was "real progress" at the end of the week and "a sufficient move to convince both sides" that the matter was worth continuing the conversation.

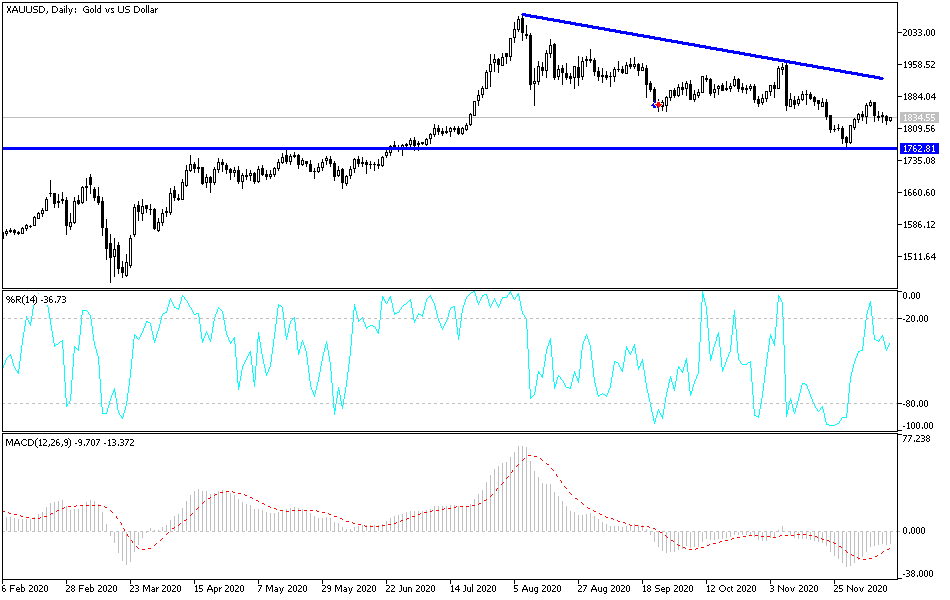

Technical analysis of gold:

According to the performance on the daily chart, the price of gold is in a relatively neutral position with a greater downward tendency. Expectations of a rebound higher will collapse if the gold price stabilizes below the support level at $1800 an ounce, which may increase sales and move towards stronger support levels. Investors' risk appetite amid optimism about coronavirus vaccines will support the bears in achieving this. On the upside, the bulls are waiting to move towards the resistance levels at 1847 and 1865 to rally towards the psychological resistance at $1900 an ounce again. In general, and based on recent performance, gold gains will be a selling opportunity.