After six trading sessions in a row, the price of gold corrected upwards. It achieved gains that reached the resistance level at $1875 an ounce, due to the decline of the US dollar and continued optimism resulting from the official distribution of coronavirus vaccines, giving a positive start for the year 2021. Accordingly, risk appetite increased, which was negative for the yellow metal, causing it to retreat to the support level at $1823 an ounce and close the week's trading stable around $1840 an ounce. By the end of last week's trading, gold prices got some momentum from the increase in coronavirus cases, uncertainty about Brexit and US stimulus, and concerns about global economic growth.

Investors were also betting that the Fed would come out with some stimulus measures at its next monetary policy meeting this week.

After talks that only lasted for months, and with only three weeks left until the end of the transition period, British Prime Minister Boris Johnson said that there was now a "strong possibility" that the United Kingdom would leave the European Union without an agreement.

US Treasury Secretary Stephen Mnuchin and House Speaker Nancy Pelosi noted the progress made in a new COVID-19 relief package, although Senate Republican Majority Leader Mitch McConnell was skeptical that concessions could be made. For her part, Pelosi suggested that the negotiations be extended after Christmas if necessary.

Coronavirus cases continue to rise in the United States and many countries across Europe, where it is said that Germany is considering imposing new lockdown measures to limit the spread of infection.

US production prices rose slightly in November, according to a report released by the Labor Department. The report also mentioned that the Producer Price Index for final demand rose 0.1% in November after rising by 0.3% in October. Economists had expected producer prices to rise 0.2%. Excluding food and energy prices, primary producer prices were still up 0.1% in November, in line with the rise recorded in October. Core prices were also expected to rise 0.2%.

According to a preliminary report from the University of Michigan, US consumer confidence unexpectedly improved in December. The report mentioned that the Consumer Confidence Index rose to 81.4 in December from a reading of 76.9 in November. The increase surprised economists, who had expected the index to drop to 76.5.

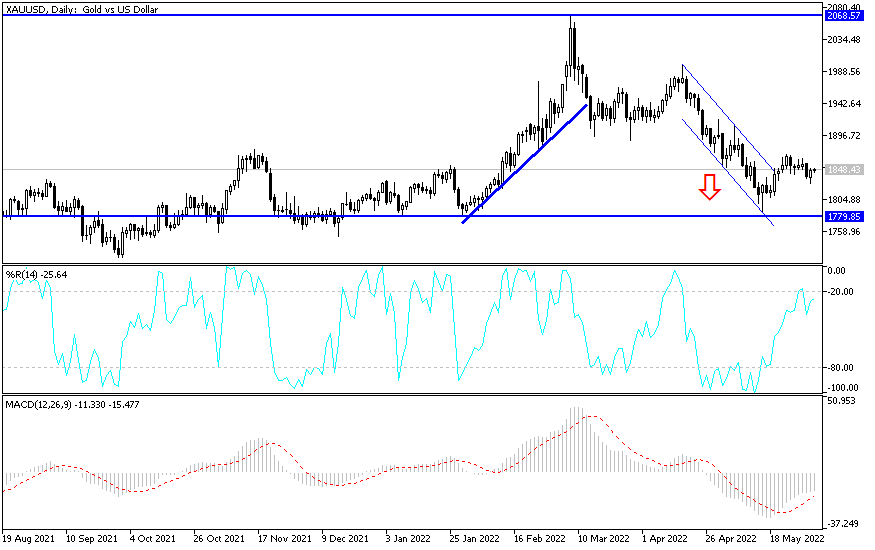

Technical analysis of gold:

After its recent performance, the price of gold is in a neutral position with a stronger bearish tendency, and this trend will be strengthened in the event that the gold price moves towards the support levels of 1822, 1810 and 1785, respectively. Accordingly, it appears that the V-shaped recovery in the price of gold has stalled before the last meeting of the US central bank of 2020 amid failed attempts to test the 50 days simple moving average at $1,875. Also, it is not clear whether the new expectations from Fed officials will affect the performance of the gold price.

In general, the price of gold may face challenges during the rest of the month as global central banks take additional measures to boost economic recovery.

The European Central Bank's decision last week to expand PEPP (Pandemic Emergency Purchase Program) by 500 billion euros to 1.850 trillion euros may add pressure on the Federal Open Market Committee (FOMC) to introduce additional monetary stimulus on December 16 amid the threat from a contracting economic recovery. The Federal Reserve may take the same approach taken by Governor Jerome Powell and aides to assess how continued asset purchases could ideally support price stability and maximum employment.

On the upward side, bulls will need to breach the resistance level at $1875 to move towards the psychological resistance level at $1900 again, which confirms that the extent of the bulls' control over performance ends recent downside expectations.