With the continued pressure on the US dollar, gold had the opportunity to move higher and reach the $1883 resistance. Despite that, investor sentiment has strengthened due to positive developments on the Brexit file, and the increasing hopes for additional stimulus in the United States, boosting demand for safe heaven assets. The price of gold was supported by reports showing the rapid spread of the new coronavirus variant, which is said to be 70% more transmissible and could increase the number of global infections to new records.

Finally, the UK and the EU have reached a post-Brexit trade agreement. News of the deal comes just one week before the December 31 deadline, offsetting recent concerns about the possibility of a no-deal Brexit. European Commission President Ursula von der Leyen said: "It has been a long and winding road, but we have a lot to show. It is fair, it is a balanced deal, and it is the right and responsible thing for both sides."

After the announcement of the US economic data package, the US government said in its report on jobless claim, that the total number of people receiving traditional state benefits decreased to 5.3 million for the week ending December 12 compared to the previous week. That number had peaked in early May at 23 million. The steady decline since then has meant that some unemployed Americans are finding work and no longer receiving help. But it also indicates that many of the unemployed have exhausted their government benefits, which usually expire after six months.

Currently, millions of unemployed Americans are collecting checks under two federal programs created in March to ease the economic pain caused by the pandemic. These programs were due to end the day after Christmas. Last week, the US Congress approved an extension as part of the $900 billion epidemic rescue package.

The supplemental federal unemployment benefit was set in the new congressional measure at $300 per week - only half of the amount submitted in March - and will expire in 11 weeks. The separate benefits program for unemployed people who have exhausted regular state aid and another benefits program for the self-employed and those in temporary jobs only will be extended until early spring, before the economy likely fully recovers.

The temporary economic recovery has been hampered by the collapse in the spring in the face of a resurgence of COVID-19 cases: an average of more than 200,000 confirmed cases per day, up from fewer than 35,000 in early September. Accordingly, US employment slowed in November for the fifth month in a row, as employers added the lowest number of jobs since April. Nearly 10 million of the 22 million people who lost their jobs when the pandemic broke out in the spring are still unemployed.

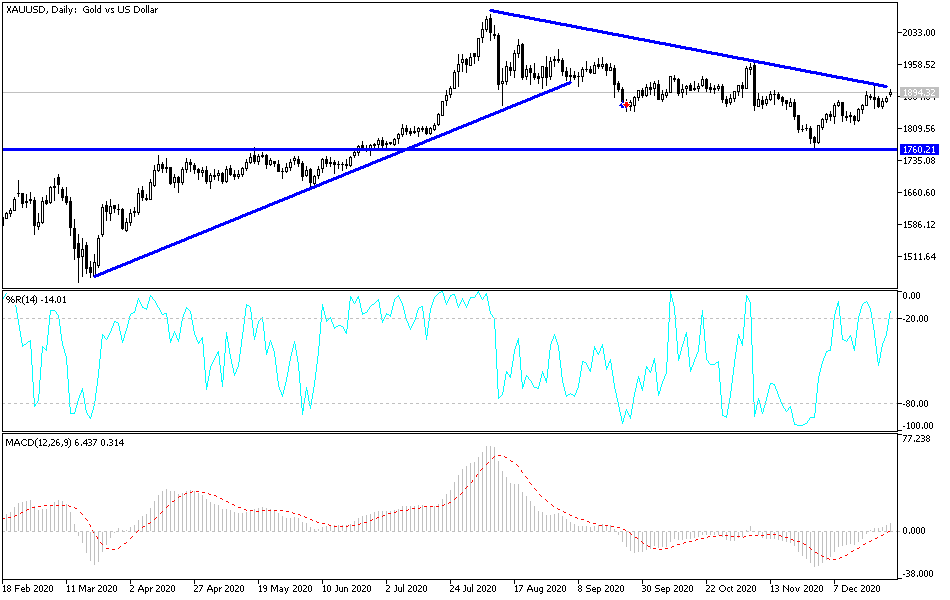

Technical analysis of gold:

On the daily chart, the price of gold moves in a neutral range with a strong tendency to rise and will strengthen more if the bulls penetrate the psychological resistance level at $1900 an ounce, which may increase buying operations and thus push the price of gold towards stronger ascending levels. The closest ones are currently 1892, 1915 and 1932, respectively. However, it must be considered that this depends on the continued decline of the US dollar and a temporary halt to the pace of investor’s risk appetite. On the downside, according to the performance over the same period, bears may control the performance if the price of gold moves towards the support levels at 1848, 1830 and 1800, respectively. Limited movements of the yellow metal are expected considering the continued impact on the markets by the Christmas and New Year holidays and the reluctance of many investors from trading the markets until the markets return to full normalcy next week. All in all, I would still prefer to buy gold from every drop.