Selling operations by investors to close 2020 contracts contributed to stopping gold gains that pushed it at the beginning of this week’s trading to the resistance level at $1907 an ounce. The price of an ounce of gold stabilized around $1860 as of this writing, awaiting the announcement of the latest package of important economic data for the week. Markets are bracing themselves for the close of financial markets ahead of the Christmas and New Year holidays, which means less liquidity and investor reluctance to take risks. The rise in the US dollar had halted gains in the yellow metal as well. The USD got some support amid fears that the new coronavirus, which has forced Britain to close most of its business, will slow the pace of economic recovery.

The news that the US Senate passed the stimulus bill also helped curb the downside of precious metals.

In the same path as the gold price, silver futures ended trading lower at $25.53 an ounce, while copper futures settled at $3.520 a pound.

The revised data released by the US Commerce Department showed that the US economy witnessed a growth of slightly more than its previous estimates in the third quarter of 2020. The report also showed that the rise in GDP in the third quarter was revised upwards to 33.4% from the previously reported 33.1%. Economists had expected the jump in GDP to hold steady.

A report issued by the National Association of Realtors showed that existing homes sales in the United States fell by 2.5% to an annual rate of 6.69 million in November after jumping by 4.4% to a revised rate of 6.86 million in October. Economists had expected existing home sales to drop 2.2% to 6.70 million from the 6.85 million originally reported for the previous month.

According to a report by the Conference Board, US consumer confidence unexpectedly decreased in the month of December. The Conference Board said the Consumer Confidence Index fell to a reading of 88.6 in December from a downwardly revised 92.9 in November. Economists had expected the Consumer Confidence Index to rise to 97.0 from 96.1 from the previous month.

On the topic of US economy stimulation, the US Senate voted by 91 to 7 late Monday to approve a coronavirus aid package and a full-year spending bill that will fund federal government activities through September 2021. The House of Representatives approved the package earlier on Monday. President Trump has returned the bill to Congress, calling it "disgraceful" given that the bill provides billions of dollars to closed American facilities, foreign countries and even the refurbishment of Congressional offices, with only $600 provided to American citizens. Trump has demanded that Congress increase the stipend to $2,000 and slash unnecessary aid to foreign countries before he signs it.

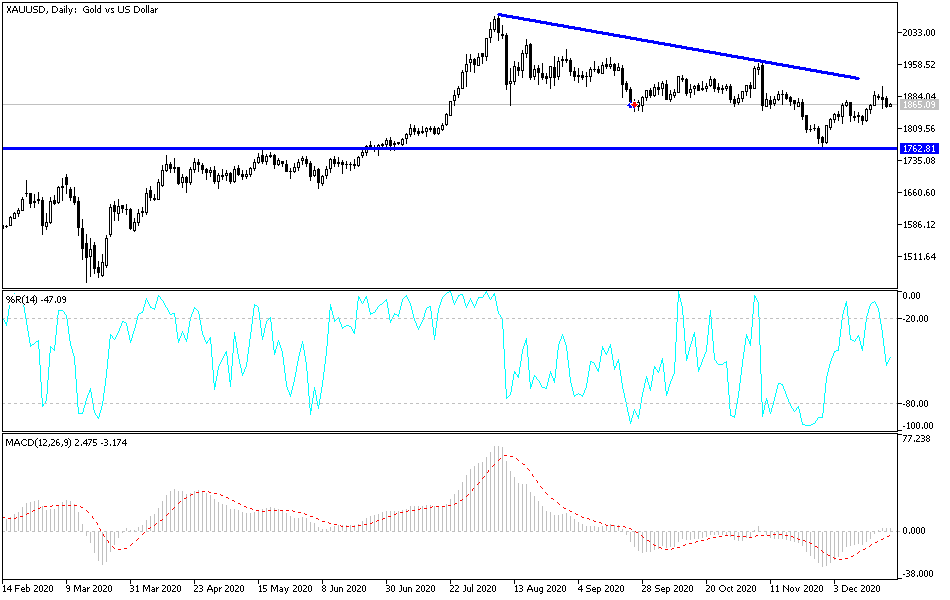

Technical analysis of gold:

I still see that buying gold from every lower level is the best trading strategy for the metal. Currently, the closest support levels for the yellow metal are 1857, 1840 and 1810, respectively, as more strains of coronavirus and the ineffectiveness of the long-awaited vaccines in eliminating them means more anxiety, and potentiallyi harder times during 2021. In that case, it will create a fertile environment for further gold gains. On the upside, psychological resistance at $1900 an ounce will remain a legitimate target for bulls, and from it, purchases will increase to push prices to stronger ascending levels. We must take into account the weak liquidity in the markets and the reluctance of investors to take risks ahead of the Christmas and New Year holidays.

The price of gold will interact today with the performance of the US dollar after the announcement of the Personal Consumption Expenditures Price Index - the Fed’s preferred measure of US inflation - as well as the average income and spending of US citizens, durable goods orders, jobless claims, and new home sales.