Gold markets fluctuated during the trading session on Friday as the non-farm payroll numbers came out. The jobs number was a bit depressing, but it also means that there is probably more stimulus coming out of the US government eventually. The Federal Reserve is going to remain very loose for the next several years, so that does provide the impetus for gold to go higher over the longer term.

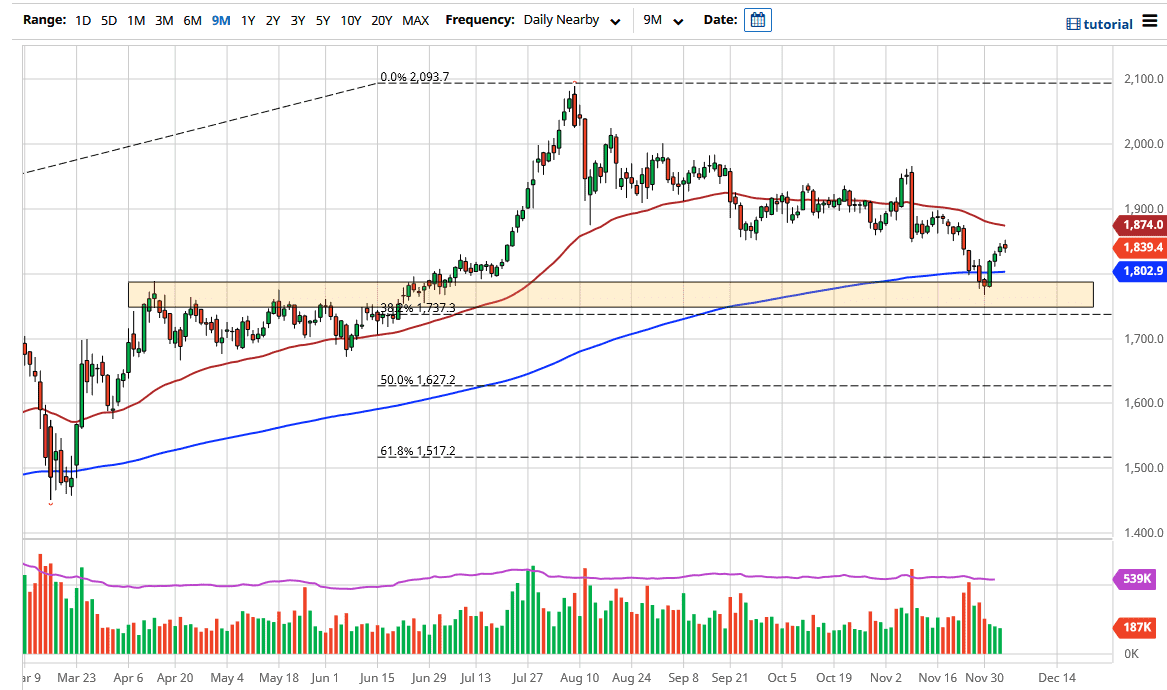

We recently bounced above the 200-day EMA to recapture it, which is a very bullish sign. Breaking above that level and recapturing the $1800 level is a good sign that we could continue the long-term trend now. Do not get me wrong - it is not as if we are going to shoot straight up in the air, but I think that longer-term traders will be better served by taking their time to buy dips and build larger positions. The 50-day EMA above will probably cause some resistance, but we are probably looking at a scenario in which we will eventually have to retest it. Pullbacks should offer plenty of buying opportunities as the US dollar continues to lose value in general. The market formed a nice-looking hammer on Monday that continues to look as if it was a major change in attitude.

Last week was interesting, because we not only saw the gold markets rally, but we also saw the euro recapture the 1.20 level, showing just how much weakness there is in the greenback. The markets continue to favor the “risk-on” trade, and it is really all about the dollar losing value. Gold will shine in that scenario, but keep in mind that various central banks around the world continue to flood the markets with liquidity, so it is not just about the dollar. With devaluation of fiat currency comes demand for “hard assets”, and gold is one of the most important ones. The candlestick for the session was a little hesitant, but having bounced more than $50 in a few days suggests that a little bit of profit-taking makes sense. I have no interest whatsoever in shorting this market.