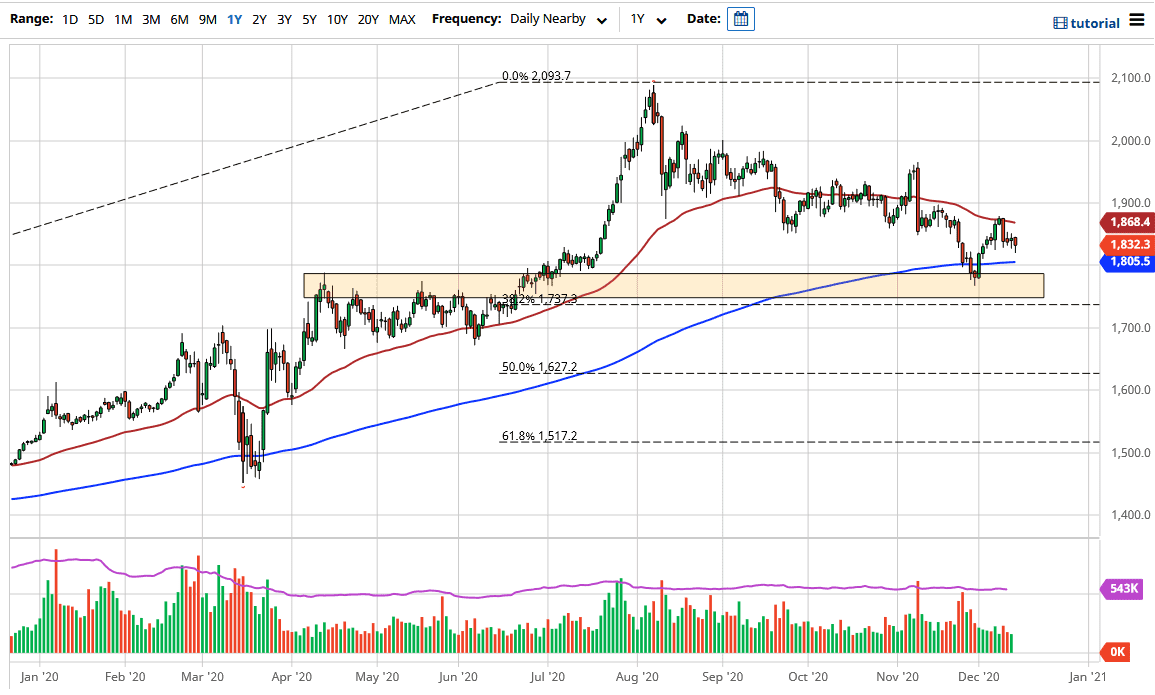

Gold markets pulled back during the trading session on Monday but seems to be finding buyers just below. You should pay attention to the 200-day EMA and the fact that it is sitting just below, near the $1805 level. It sits just above the $1800 level, which is a crucial round figure and an area from which we have seen a bounce previously. Whether or not we break down below there is something that remains to be seen. I believe that there are plenty of buyers in that general vicinity who will continue to take on risk in this market.

The market will continue to be noisy, but as stimulus talks continue in the United States, I suspect that we are going to eventually see gold take off. If we do not get stimulus, that could be a bit of a wrecking ball for this market and send gold much lower. I doubt that will happen, but the possibility remains.

To the upside, if we can break above the red 50-day EMA at the $1860 level, the market will probably go looking towards the $1900 level, possibly even the $1950 level. We have been pulling back for some time, so it will be interesting to see whether or not we can recover from this region, but right now there are plenty of headwinds in both directions which could cause gold to be rather noisy. Longer term, gold will go much higher, perhaps reaching towards the highs again, but breaking down below the recent lows would be a reason to be a bit concerned.

Keep in mind that the US dollar runs counter to what happens with gold, and if we suddenly see the US dollar losing strength, that could have a bullish effect on gold. It is only a matter of time before somebody buys gold if for no other reason than to have a bit of safety against the multitude of headlines out there that could cause issues. I believe the next catalyst will be stimulus coming out the United States, and how big that stimulus will be.