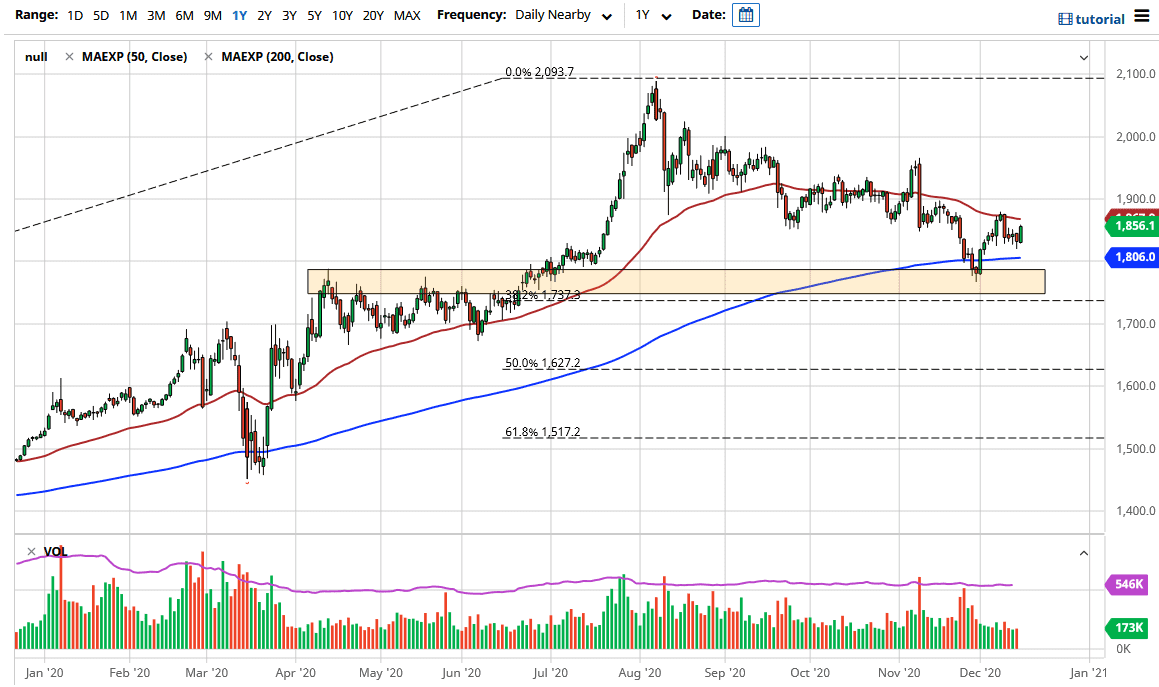

Gold markets rallied during the trading session on Tuesday after stabilizing over the last several sessions. By doing so, it suggests that the market will take on the 50-day EMA. It would make sense that at some point on Wednesday we would have that happen due to the Federal Reserve meeting over the Tuesday and Wednesday sessions, and coming out with a statement at the end of Wednesday. People will be paying close attention to what the Federal Reserve does, as far as whether they choose to extend money operations or if they disappoint the market.

By going out farther on the curve, it is possible that we could be looking at depreciation of the US dollar if longer-term treasury starts to get purchased as well by the Federal Reserve. Just as if the Federal Reserve does very little or even nothing, it could be very bad for gold as the US dollar will probably strengthen at that point. It is difficult to imagine a scenario in which that will happen, because Jerome Powell bends at the knee for Wall Street. This is a known scenario, and something that has been obvious for years. The fact that Wall Street is demanding a lower dollar suggests that we will see gold continue to grind higher, even if there is an initial push lower.

The 50-day EMA could offer a bit of resistance, but more than likely will open the door to the $1900 level. At that point, you would probably see more of a resistive level because there is a certain amount of psychology involved. Breaking above that level opens up the possibility of a move towards the $1950 level, which is an area in which we have seen massive selling. In the short term, however, we will probably look at small pullbacks as an opportunity to pick up gold “on the cheap”, especially as the 200-day EMA is sitting at the $1800 level. That is an area that eventually will try to serve as a longer-term bottom in the market.