The gold market fell during the trading session on Tuesday, reaching down towards the 50-day EMA, just as we saw in the silver market. This is a market that has a certain amount of support based on the gap from a couple of days ago. Beyond that, the 50-day EMA is right there as well, which will cause technical buying. Nonetheless, one of the things that you need to pay the most attention to is what is going on with the US dollar, as it has a negative correlation to gold, especially as of late.

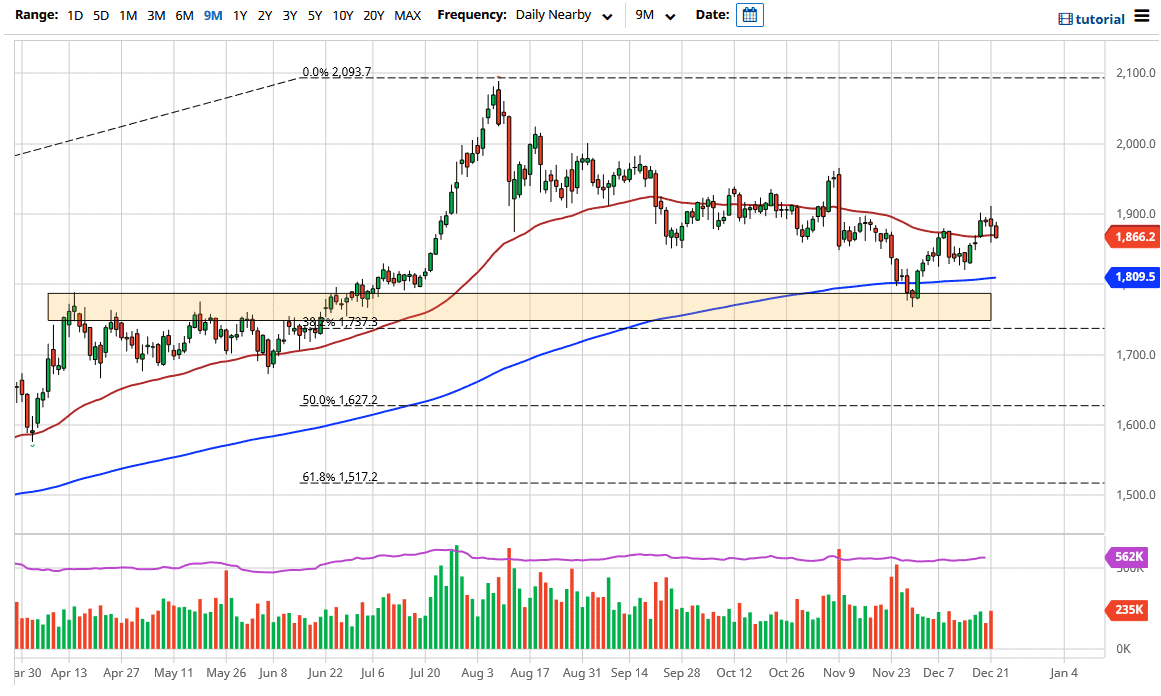

To the downside, even if we break down below the gap, there are plenty of areas in which I think buyers will be involved. The $1850 level, and then the 200-day EMA after that would come into play. The 200-day EMA is sitting at the $1809 level and is sloping higher. Pullbacks should continue to offer value regardless, especially considering that longer term, we should see plenty of stimulus coming not only out of the United States, but multiple countries around the world.

We will eventually continue to go higher, reaching towards the $1900 level, possibly even the $1950 level after that. That is an area in which we have seen a lot of selling previously, so it makes a significant target. The sign of exhaustion from that massive bearish candlestick is something that you should pay attention to, so it can take a while to get through it. If we do break above there, though, then the market is likely to go looking towards the $2000 level. We will not only get there, but even higher than that over the longer term as the liquidity measures and of course the potential “risk off trade” both come into play. I have no scenario right now in which I am willing to short gold, because that is going to be the same as going long the US dollar, which you can do in Forex pairs. On a dip from here, I would anticipate that should be plenty of value hunting going on that we can take use to our advantage. Nonetheless, volume is going to be an issue over the next week or so, so you may have to have a smaller position on to protect your account.