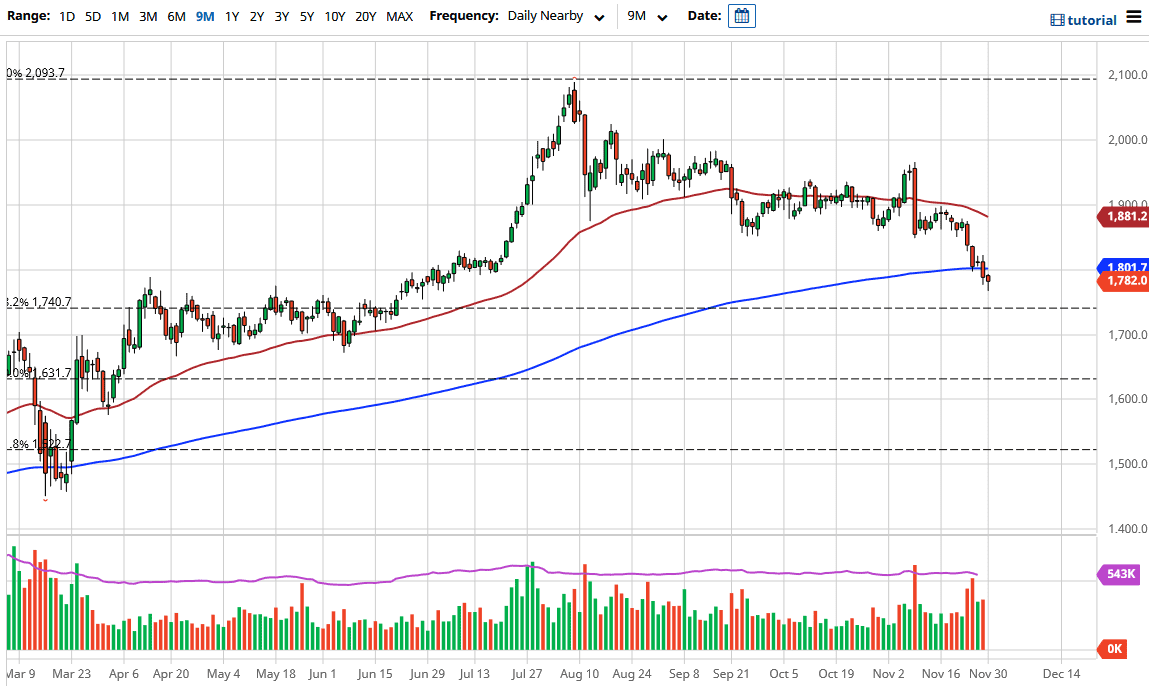

Gold markets fell during the trading session on Monday, but found enough buyers underneath to turn things around and form a hammer. That hammer is a very bullish sign, and a welcome one for those who have been waiting for a reason to start buying gold. I think you have to assume that gold is somewhat oversold. Because of this, market participants will continue to look at this market as a value proposition occasionally, and clearly a lot of traders will try to take advantage of value when it shows up.

In that case, I anticipate that gold will turn around rather soon, but we also have to worry about what is going on with the US dollar. The question now is whether or not the US dollar is going to run counter to what the gold markets do, or if we will see some value play. It is a little hard to tell at this point, but I think that we eventually will find buyers for gold regardless. If we do, then gold is likely to be one of the big winners going into December. It is hard to tell exactly what happened with gold, because there are so many crosscurrents going on at the same time that it is easy to get lost in a narrative or story. It is easier to just follow the money as it were, deciding whether or not to try to ride any bounce.

From a longer-term standpoint, gold has much higher to go due to central bank liquidity measures and the like. Because of this, I have no interest in shorting this market, and eventually the longer-term players will come in and start holding on to gold. Gold will go looking towards the highs again, and beyond. In the meantime, though, it might be very noisy as the world tries to figure out what is next for global growth and risk appetite.