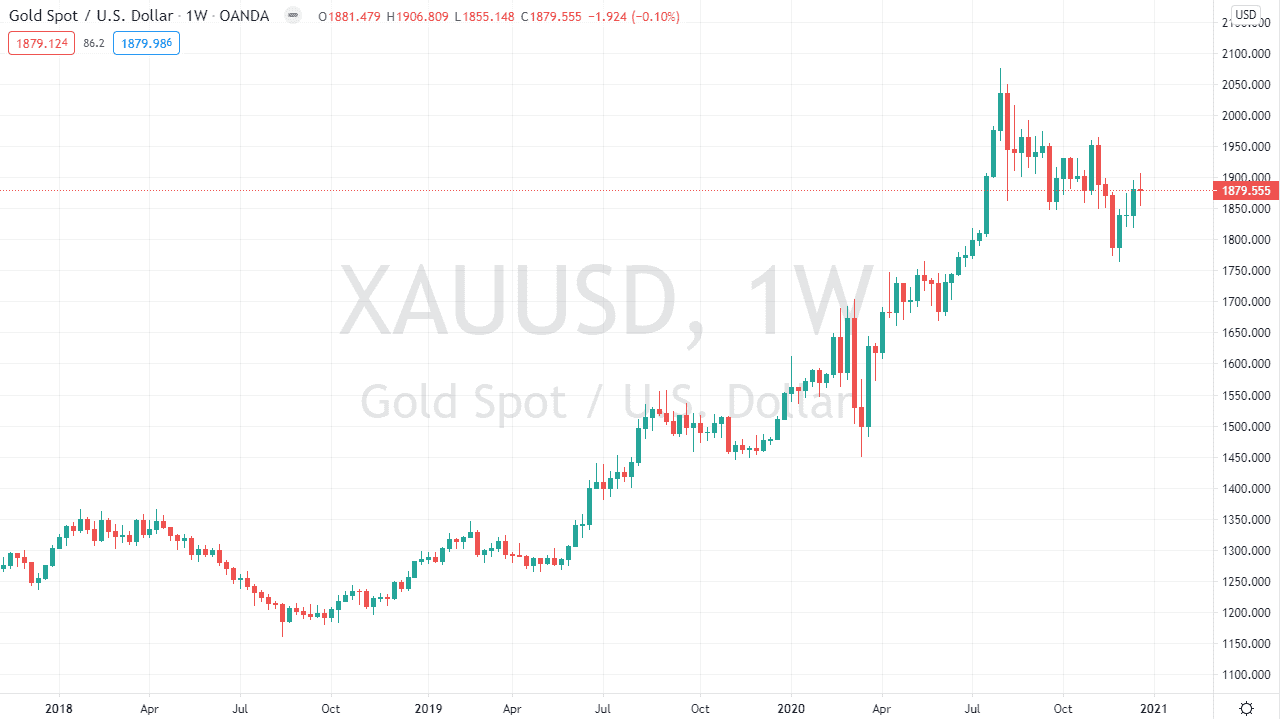

Gold markets have recently been drifting lower, pulling back from the $2100 level which was the recent high. It has been a gentle and grinding drop from that level, so we have formed a descending and bearish channel all the way down to the $1800 region. That is a large, round, psychologically significant figure and attracts a certain amount of attention. We have reversed from there, and it should also be noted that the 200-day EMA is just below that area on the daily timeframe, which is something that a lot of people will be watching. Gold does move on more than just technicals, so we have to pay attention to quite a few different issues.

The candlestick that catches my attention the most is the weekly neutral candlestick that formed at the end of Christmas week. At this point, it does look like we are running into a bit of resistance just above, but if we were to break above the $1900 level, that could send more money flooding into the market, perhaps trying to push gold towards the $1950 level. In the meantime, I would anticipate the occasional pullback, but it is a market that looks like it will continue to rally in general. This can be based upon several things at the same time, not the least of which would be the significant stimulus that is almost certainly going to be coming from the United States.

Speaking of the stimulus, you should keep in mind that even though nothing has been signed quite yet, it is only a matter of time before we get there. Even if Trump does not sign the stimulus, it is only a matter of time before Joe Biden would. We are most certainly going to get stimulus and that should continue to help boost gold. A short-term pullback between now and then is only more than likely going to offer value. Beyond that, there are so many different things going on around the world right now that it is hard to argue with the idea of a potential “safety trade” coming into play that should pick up gold as well. By the end of January, gold should be higher, rather than lower.