A last-minute agreement was signed between the European Union and Britain before the Christmas holiday, causing positive sentiment in the trading of the pound against the rest of other major currencies. The GBP/USD rose to the 1.3620 level before settling around the 1.3533 level at the beginning of trading this last week of 2020. This came after an official announcement of a Brexit trade agreement between Britain and the European Union, with a tepid response that is likely to reflect uncertainty about the contents of the agreements and the path of ratification.

Despite the Brexit deal, many analysts have long warned that the Brexit agreement will lead to a slow but steady erosion of the highly interconnected relationship between Britain and the European Union, so many expected that the final agreement would lead to only a limited appreciation of the pound. So far in the immediate aftermath, Kit Juckes, chief Forex strategist at Societe Generale, said in a note to clients: “I expect to trade the GBP/USD pair to the middle of the 1.40 high next year if there is a Brexit deal. We will have to wait and see if we are going to get a US financial deal that has already been signed by the president, or a trade agreement between the European Union and the UK. It would be a good idea to put these two thorny issues in time to focus on the Christmas trades."

Therefore, the silent price action may also reflect lower trading volumes prior to the ceremonial breakout and the resulting reticence between fewer investors and active traders to participate considering the potential bumpy path in the future. Accordingly, doubts remain, and it is possible that the fluctuations will exist in trading.

The UK's GDP for the third quarter outperformed the expected change (QoQ) of 15.5% with a change of 16%. The reading (on an annual basis) outperformed -9.6% with a change of -8.6%. Total business investment for the first quarter increased over the estimated change (quarterly) by 8.8% with a rate of 9.4%, while the reading increased on an annual basis on - 20.7% with a reading of -19.2%.

Millions of people in the UK faced severe new coronavirus restrictions as Scotland and Northern Ireland called for tougher measures to try to stop a new type of virus believed to be spreading faster. Therefore, Northern Ireland entered a six-week lockdown, and in Wales, restrictions that were relaxed on Christmas Day were re-imposed. All in all, the number of people subjected to the highest level of restrictions in England - Level 4 - rose by 6 million on Saturday to 24 million people overall, about 43% of England's population. The region included London and many surrounding areas.

According to the restrictions, mixing of families is not permitted inside the home, and only essential travel is permitted. Accordingly, gymnasiums, swimming pools, hairdressers and shops selling non-essential goods have been ordered to close, and bars and restaurants can only eat outside. Business groups say the restrictions will be economically disruptive to their members.

Accordingly, another 570 daily deaths from COVID-19 were reported, bringing the total death toll in Britain to 70,195, the second worst death toll in Europe after Italy. Britain also reported more than 32,700 new cases of the disease on Christmas Day.

From the USA, the annual GDP growth for the third quarter exceeded expectations of 33.1% with a rate of 33.4%. The reading increased over expectations for the quarter to -2%, with a reading of 3.7%. Durable goods orders for November were topped 0.6% with a 0.9% change.

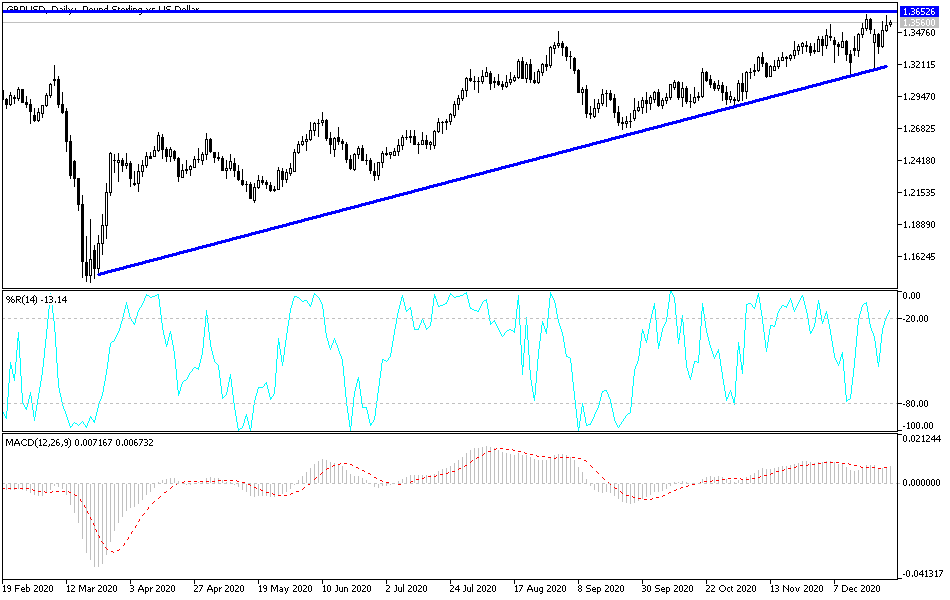

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD is trading within the formation of an upward channel. This indicates a significant upward short-term bias in market sentiment. The pair recently pulled back into normal trading territory, away from the overbought levels of the 14-hour RSI. Accordingly, the bulls will target short-term gains around the 1.3598 resistance or higher at 1.3655. On the other hand, the bears will be looking to take advantage of the pullbacks by targeting profits around 1.3478 or below at 1.3420.

In the long term, and according to the performance on the daily chart, it appears that the GBP/USD is trading within a sharply rising wedge formation. This indicates a strong long-term bullish momentum in market sentiment. The currency pair has recently declined to return to the normal 14-day RSI trading territory. Accordingly, the bulls are looking to extend the current gains towards 1.3839 or higher, to 1.4121. On the other hand, the bears will be targeting a long-term pullback around 1.3266 or below at 1.2975.

Today's economic calendar has no important and influential economic data from the United States or Britain.