For the second month in a row, the British pound continues to achieve gains from optimism regarding a Brexit trade deal. The GBP/USD pair jumped to the resistance level at 1.3442 at the beginning of December's trading, its highest level in three months, before stabilizing around 1.3418 at the time of writing. There are recent signs that indicate that trade negotiators are continuing to move towards a trade deal after Brexit, supported by positive comments from German Chancellor Angela Merkel, who is urging negotiators to "put all our efforts in the last step."

The GBP/USD gained by 3.0% in November, but it appears that the majority of the move was due to the weakening of the US dollar rather than the strength of the pound sterling. All in all, the pound to euro exchange rate - the leading exchange rate for Brexit sentiment - was only able to rise 0.43% in November, plus October's gains of 0.80%. Gains were not meteoric, but they reveal the basic assumption in the market that a deal will be struck, although some analysts warn of the possibility of a pullback due to any disappointing news. Chris Beauchamp, Senior Market Analyst at IG says, “After the gains in recent weeks, the British pound also appears vulnerable to a bearish move as the Brexit process intensifies again. The rhetoric from both sides has reached its climax, because despite all protests to the contrary, real progress on fisheries and equal opportunity appears to be lacking. Like stocks, the British pound has been somewhat immune to the recent bad news, but after a huge rally, not only since September, but since the middle of the year as well, it will need some really good news to avoid a fall in December, when the reality of a no-deal Brexit begins to increase."

The market is currently trading on unofficial news, as government sources and members of the various negotiating teams inform members of the press informally about the latest developments. This means that the pound can move based on false rumors, creating a frenzied atmosphere where volatility is high but the directional advance is slow, as investors see little benefit in taking a large directional bet on a currency where visibility is very low.

Reuters Market Analyst Andrew Spencer commented on the performance and course of the negotiations, saying: “The British pound is consolidating around 1.3350 for the seventh day, as the market awaits the outcome of Brexit negotiations. The only certainty is that volatility is coming - with the increased risk that relations between the UK and the European Union will remain strained even after any deal."

However, the general assumption is that a deal will be struck, even if conviction is shaken.

Regarding the latest developments, ITV political editor Robert Piston says, “My sources in the UK government say that you can see a political solution to the impasse in the free trade talks in the European Union which is related to equal opportunity, state aid and enforcement conditions, but the EU’s proposal about fishing rights in UK waters is completely unacceptable. In contrast, Brussels sources say the exact opposite: that fishing appears amenable to being sorted while the gap in the field of equal play/state aid/enforcement continues to widen. Although confusing, this may reflect the different priorities on each side. Ironically, these are reasons to be optimistic that a settlement is within reach."

Accordingly, German Chancellor Angela Merkel increased her cautious sense of optimism when she said on Monday that she hopes for a positive outcome to the negotiations, and that some European Union countries "are losing some patience." She also said that the concern of some member states was that the time needed to reach an agreement was running out. She said getting a deal would require a "clever hand".

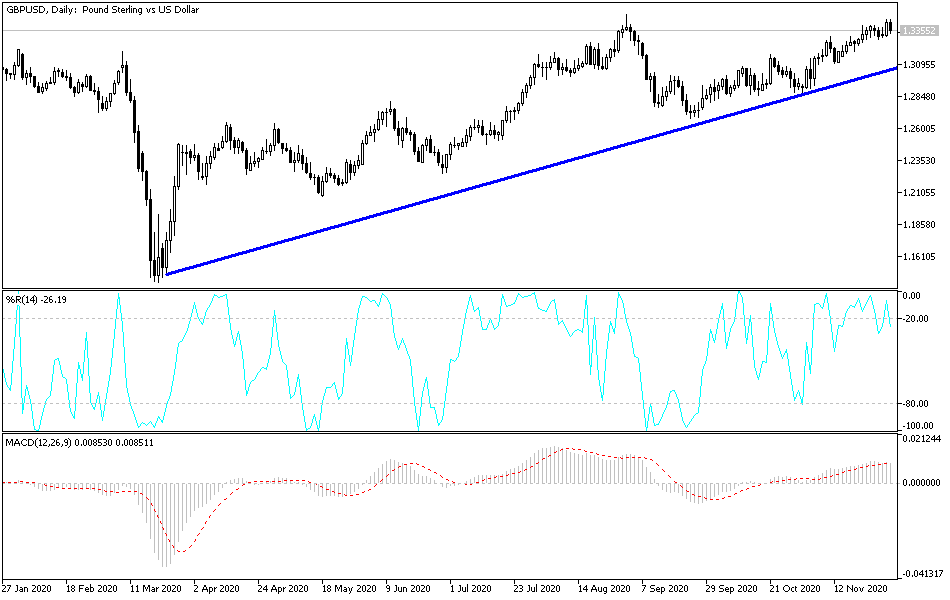

Technical analysis of the pair:

On the daily chart, the GBP/USD currency pair is still in an upward correction range, and the recent breakout above the 1.3400 resistance has pushed some technical indicators into overbought areas. Therefore, any negative development in the Brexit negotiations will translate into strong selling and sharp profit-taking. The resistance levels at 1.3455, 1.3520 and 1.3600 will be the best suited to do so at the present time. On the downside, no shift in the general direction to the downside will occur without the bears breaking the support level of 1.3200 as a first stage.

There are no significant British economic publications today. In the United States, the ADP reading for US non-farm payroll numbers will be announced, and then the content of the second testimony of Federal Reserve Governor Jerome Powell.