Instability has dominated the GBP/USD's performance in recent sessions due to investor optimism regarding coronavirus vaccines. In those sessions, the GBP/USD pair continued in a range between the 1.3288 support and the 1.3398 resistance and stabilized around 1.3340 at the time of this writing.

The British Foreign Secretary said that there is only about a week left of Brexit talks, so the United Kingdom and the European Union must speed up the conclusion of the trade agreement. Fishing rights remain the main obstacle to the completion of the deal. With talks continuing between the two sides in London, Foreign Minister Dominic Raab said, "I think we entered the last week or so of substantive negotiations." In this regard, the European Union was said to be prepared to provide up to 15-18% of its fish quota, which was immediately rejected as offensive by sources on the British side, as reported by national media.

Despite the apparent stalemate, Raab told Sky News: "There is a deal to be made."

He added that the two sides had made progress on the issues of "equal opportunity" - the criteria that the UK must meet to export to the European Union. The biggest hurdle appears to be fisheries, a small part of the economy with great symbolic significance for the maritime nations of Europe. The countries of the European Union want their boats to be able to continue fishing in British waters, while the United Kingdom insists it must control access and quotas. "With regard to fisheries, there is a point of principle: As we emerge from the transition phase, we are an independent coastal state and we should be able to control our waters," said British Minister Raab.

On the other hand, the chief negotiator for the European Union, Michel Barnier, who met over the weekend with his British counterpart David Frost, said that there were still "big differences".

If there is no deal between the two sides of Brexit, then New Year’s Day will bring great disruption, with tariffs and other obstacles to trade between the UK and the EU. This will hurt both sides, but the burden will fall further on British shoulders, as Britain does nearly half its trade with the European Union.

Commenting on sterling's performance, Niksch Sugani, an economist at Lloyds Bank, said: “The British pound remains close to the upper end of its recent trading range against the euro and has been steady and stable against the dollar, indicating that markets remain optimistic about the prospect of a deal,”.

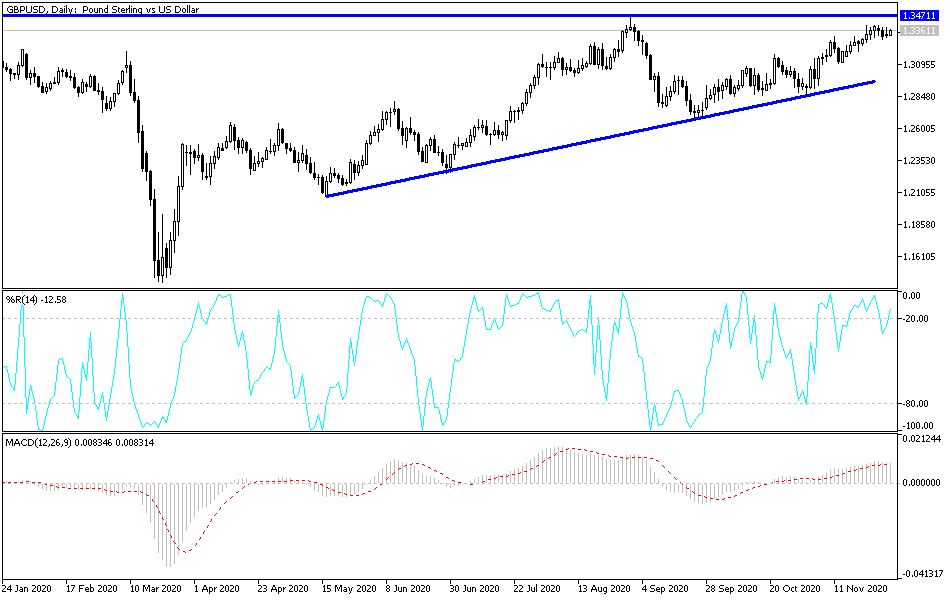

Technical analysis of the pair:

As per the performance on the daily chart, it seems clear that the GBP/USD currency pair moves in narrow ranges, which technically predicts the possibility of strong movements in the coming days in one of two directions. So far, the upside opportunity is still present and may be supported by positive developments on Brexit negotiations. If that happens, the psychological resistance at 1.3500 will be the closest target for the bulls. At the same time, it will push technical indicators over the same period of time to overbought areas. On the downside, 1.3200 will remain the most important support level for bears to start controlling performance again.

Today's economic calendar:

For the GBP, the Industrial Purchasing Managers' Index will be announced. For the USD, the ISM Manufacturing PMI and Construction Spending Index will be announced, and later Fed Governor Jerome Powell's testimony.