The GBP/USD gained strong momentum during yesterday's trading session that pushed it towards the 1.3649 resistance, the pair's highest level since April 2018, where it stabilized as of this writing. The latest support for the pound came from the approval of AstraZeneca's COVID-19 vaccine for emergency use in the UK, which raised hopes for a return to normal life. The UK Medicines and Healthcare Regulatory Agency has approved AstraZeneca's COVID-19 vaccine to provide emergency supplies in the UK, with the first doses released today. Therefore, vaccinations may begin early in the new year.

The pound sterling rose against all major currencies in the Forex market, which now prefers risky assets such as stocks and commodities after leaders of the European Commission and the European Council signed the UK-EU trade agreement in Brussels ahead of the parliamentary votes. Commenting on future relations, Charles Michel, former Belgian prime minister and current leader of the European Council, said: “The European Union is ready to work side by side with the UK. This will be the case with regard to climate change, prior to the twenty-sixth session of the Conference of the Parties in Glasgow, and the global response to epidemics, particularly through a potential treaty on pandemics. In foreign affairs, we will seek cooperation on specific issues on the basis of common values and interests. These are major issues that must be discussed on a regular basis, as we do with our strategic partners, and I look forward to such cooperation.”

In Europe, the treaty will be implemented provisionally, pending ratification in London as well as the adoption of a rubber stamp by the European Parliament. The agreement avoids a trade gap that was widely feared in the markets during the four years since the June 2016 referendum on Brexit. This reduces the direct threat to the pound, although it also creates many uncertainties in the medium and long term, including the fate of Britain's dominant service industry.

US lawmakers continue to split over increasing direct payments as proposed by President Donald Trump. Senate Majority Leader Mitch McConnell on Tuesday halted a Democrat bid to pass a bill that would grant $2,000 in direct payments instead of $600 to most Americans.

Data from the Nationwide Building Society showed that UK house prices grew at the fastest pace in six years in December as the property market remained resilient despite the pandemic. According to the results, house prices rose 7.3 percent year-on-year in December, after November's increase of 6.5 percent. Prices were expected to rise by 6.7%.

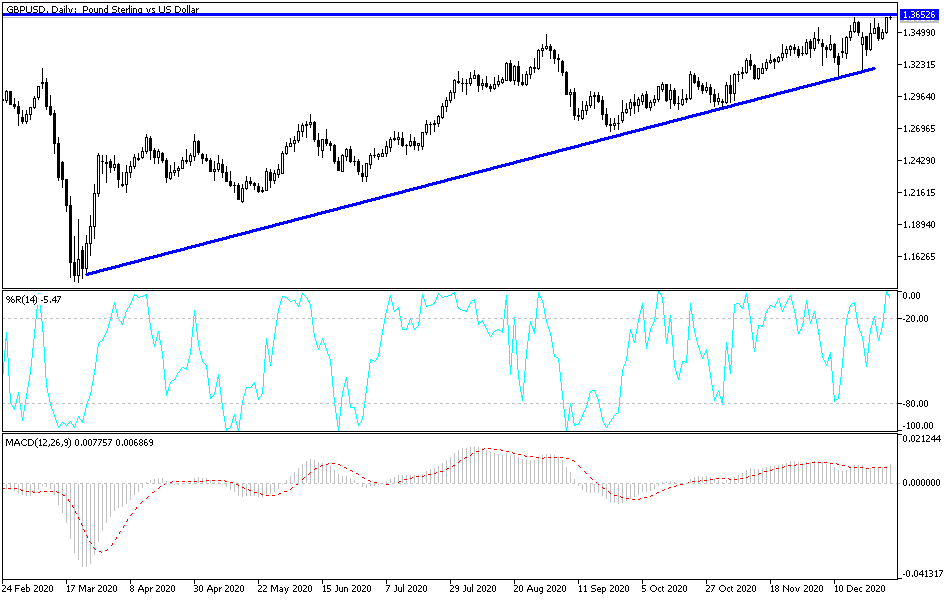

Technical analysis of the pair:

As per the daily chart, the GBP/USD pair still has a chance to rise and continue the general trend. The bounce will be slow due to the lack of liquidity in the markets, with the absence of many investors from the markets until the end of the holiday season. The next bulls' targets are 1.3665, 1.3720 and 1.3800, respectively. On the downside, according to performance over the same period, there will be no return to the bears' control without breaching the 1.3290 support. The pair is on its way to close 2020 transactions on a strong rise. The Brexit agreement, along with the announcement of coronavirus vaccines, the presidential elections and the collapse of the dollar were the real reasons for the rally that dominated the performance of the currency pair in the recent period.

The pair is not expecting any important British data. From the United States, there will be the announcement of the weekly jobless claims.