The pound did not celebrate its highest gains since early 2018, as pressures returned again. Those pressures came not only with discouraging Brexit negotiations, but also with new lockdowns amid the emergence of a new strain of the coronavirus, originating in Britain. Therefore, the GBP/USD pair retreated at the beginning of this week's trading to the support level at 1.3335, where it is stable at the time of this writing, after gains last week pushed the pair towards the 1.3624 resistance.

The British pound suffered profit-taking sell-offs ahead of the weekend on Friday, making it the worst-performing major currency during that session, although it was still the third-best performance during the week after being lifted by previous indications that the Brexit trade deal had almost been ratified. But the pressure on sterling will return after British Prime Minister Boris Johnson put much of England back into lockdown, citing a new and more contagious strain of the coronavirus that has become a bend for the economy and optimists who had hoped the launch of the vaccine would ensure a strong recovery in 2021.

In this regard, British Health Minister Matt Hancock said in an interview with Sky News: "It will be very difficult to keep it under control until the vaccine is released. We still have a long way to go to sort that out. Basically, we must launch this vaccine to make people safe. All the different measures that we apply, we need more of them to control the spread of the new variant than we did to control the spread of the old virus. This is the basic problem.”

Accordingly, government officials say they are urgently seeking to understand the death rate that comes with the new transformation of the disease, as well as whether it will respond to the various coronavirus vaccines expected to be launched in the coming months. But the problem sterling faces is that even if the new vaccines fit the new variant, companies and the economy could face months of previously unexpected torture at the hands of the government.

"We expect almost all of the highly vulnerable population to be vaccinated by the first quarter of 2021, and possibly as much as half of the population by summer, which will boost the UK's recovery from the pandemic," says Sanjay Raja, an economist at Deutsche Bank. "It won't be a smooth ride. Certainly, continued monetary and financial support (or maybe more) will be needed to get the economy back on track. As such, Brexit and the ongoing restrictions should slow down the UK's recovery in Q1-2021.”

The failed attempts thus far to contain the virus are expected to continue, and if it appears that the new variant cannot be treated with existing vaccines, it may become more than just a short-term problem for sterling. The pound and the UK economy are thus joining many of their European and North American counterparts in a renewed state of lockdown this week, although the pound will also have to face yet another threat from the government to pursue a "no-deal" Brexit.

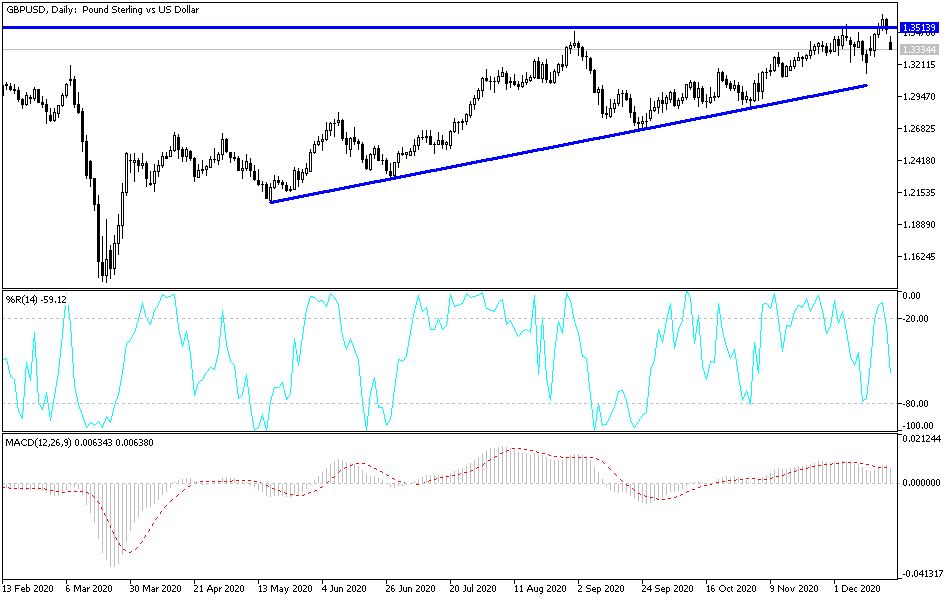

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD currency pair is trading within an ascending channel formation. This indicates a significant short-term bullish bias in market sentiment. Accordingly, the bulls will look to extend the current bullish trend by targeting profits at around 1.3554 or higher at 1.3598. On the other hand, the bears will be looking to pull for short-term gains around 1.3455 or below at 1.3400.

In the long term, and judging by the performance on the daily chart, it appears that the GBP/USD is trading within a sharp bullish channel. This indicates a strong long-term bullish bias in market sentiment. Accordingly, the bulls will look to extend the current gains towards 1.3631 or higher to 1.3839. On the other hand, the bears will target long-term pullbacks around 1.3379 or lower at 1.3191.