A Brexit deal would mean a good year for sterling in 2021, which is what Forex investors are hoping for, as global financial markets are no longer able to withstand more shocks in the coming year. Despite the development of vaccines to eliminate the coronavirus, new strains of the epidemic have appeared and restrictions on global economic activity have returned at an active time for holiday travels. The GBP/USD performance had increased volatility due to coronavirus developments and the apparent impossibility of a Brexit agreement before the deadline. The beginning of this week's transactions was devastating to the GBP/USD as it collapsed to the 1.3188 support, with Britain now an active scene for the new epidemic mutation and in international isolation. The pair rose again and established at 1.3490 during yesterday’s trading, but amid increasing pessimism towards the pound and risk aversion, the pair settled around the 1.3365 support at the beginning of Wednesday’s trading.

The pound's trading versus the rest of major currencies was also affected by low volumes, lack of liquidity, risk aversion, and the recent rise in the US dollar as a safe haven. Commenting on the performance, John Hardy, Head Forex Strategist at Saxo Bank says: “Influenced by the strength of the US dollar yesterday, along with falling and rising concerns over Brexit, (today, the European Union rejected the latest British fisheries concession), the pound showed great volatility against the US dollar, and will remain so until we finally know what shape Brexit will take until the end of the year. The 1.3500 resistance level is the focal point here, but we are likely to be in a completely different place within a month, be it higher or lower.”

The EU and UK only have a little more than a week until the end of the Brexit transition period on Dec. 31, and the UK was falling behind on dealing with the bloc according to the rules of the World Trade Organization (WTO), and thus tariffs will be applied. However, actually, there's less than that time remaining, given that it takes days if not longer for the new bill to become a law.

One of sterling's short-term problems is that the UK and all EU parliaments will need to ratify any agreement before it enters into force, meaning that there is a chance of more problems even if negotiators manage to overcome the last remaining hurdles during the talks, so the British pound may continue suffering from short-term losses if it begins to look likely that ratification will not be possible until the new year.

“Price action has remained in a much narrower range this morning and far from the 1.31 low,” says Shawn Osborne, Scotiabank's chief forex strategist. "Settlement on fisheries means that the agreement is very close, but we remain skeptical that negotiators will reach a decision on the remaining major issues before the end of the year (or at least the end of the legislative year) - we expect the cable to continue to weaken."

On the Brexit negotiations, pro-Brexit lawmakers have already indicated that they will be reluctant to grant their stamp of approval to anything Prime Minister Boris Johnson agrees to without having time to "wade into the matter with a fine-tooth comb". Accordingly, it is expected that any agreement will include thousands of pages of legal terms, making it likely impossible to scrutinize in a matter of days, and under these circumstances, it is possible for some government representatives to abstain from voting in any immediate parliamentary vote.

All in all, given the degree of abstention or rejection among MPs, British Prime Minister Johnson might be at the mercy of the opposing Labour party. Moreover, depending on the extent of any concessions contained in the final agreement, Johnson may struggle to garner sufficient support for the agreement within his own party without lawmakers having time to review it. This may be especially important now that the two sides are no longer in dispute over the so-called equal opportunity clauses demanded by Brussels.

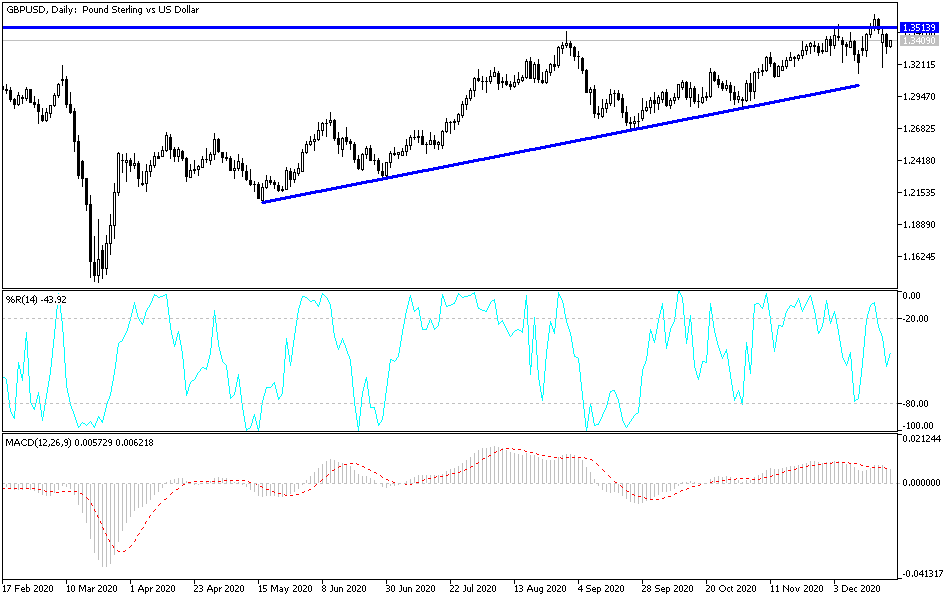

Technical analysis of the pair:

Volatility and instability will remain the most prominent elements of the GBP/USD performance for the rest of 2020 trading. Optimists see the possibility of reaching an agreement in the last hours, and if that happens, it will save the sterling from a free fall against the rest of currencies. However, 2021 will see the pound fall if a Brexit deal is not agreed upon. Then, investors' focus will shift to economic performance, the extent of coronavirus' impact, and efforts to eliminate it. So far, the GBP/USD currency pair still has a bullish opportunity, as it is holding onto stability above the 1.3300 resistance as shown on the daily chart, and the 1.3500 high remains a symbol of the bulls' control. On the other hand, according to the performance over the same period, breaking the 1.3120 support will lead to the bears domination and thus moving towards stronger support levels.

The currency pair is not expecting any significant UK data, but there are US economic data, the most prominent of which is the reading of the Personal Consumption Expenditure Price Index - the Fed’s preferred measure of US inflation - as well as the average income and spending of American citizens, durable goods orders, unemployed claims and new home sales.