The emergence of a new coronavirus strain and the rapid total closure in the UK increased the pressure on the sterling against the rest of other major currencies at the beginning of this week's trading. The concern about COVID-19 is added to fears of failure in Brexit negotiations, which contributed to a sharp downward move for the GBP/USD to the 1.3188 support, before it quickly resumed moving towards the 1.3500 resistance at the time of this writing. Boris Johnson is proposing Articles to solve the fishing problem that impedes the completion of the trade agreement with the European Union. Yesterday's session was the worst daily performance for the GBP/USD pair in three months. As I mentioned before, extreme volatility in the currency pair will be possible, as it is subject to any update on the performance of Brexit negotiations.

Dozens of countries around the world have imposed strict restrictions on travel to and from the United Kingdom due to a new strain of the pandemic believed to be more contagious than the existing one. From Canada to India, one country after another banned flights from Britain, while France banned British trucks for 48 hours while evaluating the virus. After a conversation with French President Emmanuel Macron, British Prime Minister Boris Johnson said he understood the cause of the restrictions and hoped for a speedy resumption of the free flow of traffic between the UK and France, possibly within a few hours.

He said that officials from the two countries are working "to free the flow of trade as soon as possible." For his part, Macron said earlier that France is considering systematically testing people for the virus upon their arrival. Over the weekend, British Prime Minister Johnson imposed strict lockdown measures in London and surrounding areas as Health Secretary Matt Hancock said the new strain was "out of control". Experts said that preliminary evidence indicates that the strain is not deadlier, and they expressed confidence that the vaccines now being introduced would still be effective against it.

Problems increased on Monday regarding the attempt to secure a trade deal between the European Union and the United Kingdom before the end of the transition period for Britain’s exit from the European Union on New Year’s Day. The EU Legislative Council insisted that the protracted negotiations left the legislators without enough time to agree to the deal. Meanwhile, British Prime Minister Boris Johnson has shown indifference over whether or not a deal will be struck, saying Britain will "thrive in strength" even if the talks collapse. But at the same time, Johnson said: "This does not mean that we do not want a deal."

British and EU negotiators are still at a deadlock over fishing rights, with only 10 days left before the messy and costly economic disruption between the two sides becomes official. With the exception of a late breakthrough, it will impose tariffs on trade between the two sides, in addition to customs and other administrative red tape imposed by Britain's decision to withdraw from the 27-nation bloc.

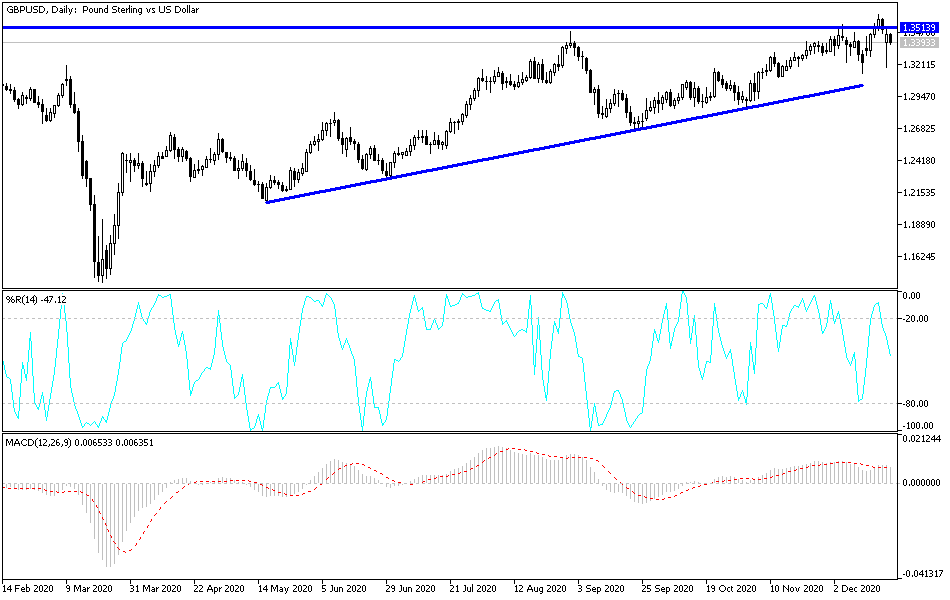

Technical analysis of the pair:

According to the performance on the daily chart, the GBP/USD's stability around and the above the 1.3500 resistance will be in favor of the bulls. The pair is preparing for stronger gains in the event of a long-awaited Brexit deal, and we do not rule out reaching the 1.4000 psychological peak quickly when that happens. On the other hand, a last-minute no-deal Brexit, a possibility that seems weak, will mean a rapid collapse of almost all of the pound's gains throughout 2020. A hard Brexit, along with the coronavirus, would cause a double pressure factor for the sterling’s future.

Today's economic calendar:

For the GBP, the rate of GDP growth and the rate of fixed assets investment will be announced, as well as net public sector borrowing and current account data. Among the most important releases from the United States of America are the GDP growth rate, the US Consumer Confidence Index and the existing US home sales.