Contention between the European Union and the UK over the future of a trade deal continues, despite optimistic statements by the negotiating parties about a possibility last-minute agreement. This explains the fluctuation in the performance of the GBP/USD pair towards a greater upward trend amid the collapse of the US currency to its lowest level in two-and-a-half years. The pair's performance is also affected by investor risk appetite stemming from the initiation of coronavirus vaccinations. Both the U.K. and the U.S. have approved the Pfizer vaccine with the possibility of approval for more vaccines from other international companies. Since the beginning of this week’s trading, the currency pair has been in an upward range, stabilizing around the 1.3452 resistance. The pair awaits developments on the ground regarding Brexit, which is the most influential factor in the GBP's near future.

Contributing to the pound’s recent gains against other major currencies was a last-hour uproar among Conservative MPs that the UK was heading towards the Brexit deal with the European Union. That reassured EU skeptics that “they will be happy”, as per a tweet from Nicholas Watt, BBC Newsnight's political editor. The tweet was picked up by market news, with traders and Forex commentators indicating that it has influenced the GBP's rally.

The announcement by Reyes Mug that Parliament would meet on December 21 and 22 was a rumour, but it appears that several market participants wanted to support that rumour. So, it is interesting to see an informal push from the UK Cabinet to reassure seasoned Brexit supporters. They have been informed that their concerns have been addressed. The main issue is about equal opportunity, a mechanism in which the European Union and the UK adhere to common rules but in a way that respects the sovereignty of both parties.

Amid successive press releases, other journalists are urging caution. “Nothing is imminent about Brexit until today,” says Bruno Waterfield of The Times.

Adam Parsons of Sky News said: "I know Westminster is apparently talking about an imminent deal on Brexit, but I haven't heard anyone say that among Brussels diplomats.” Richard Coliborn, BBC News Europe's editor, said: “Both British and European officials in Brussels are very much informed tonight that they do not expect an imminent breakthrough on the Brexit deal."

Meanwhile, news sources say that the Conservative "Brexiters" want to see a deal by Thursday if they are to have time to hold a meaningful vote on it next week.

Official figures show that the number of people who lost their jobs in the UK reached a record high in the third quarter, in the run-up to the planned completion of the government payroll subsidy program. According to the data, layoffs reached 370,000 in the period from August to October, a record number for three months. At the end of October, the British government was planning to end the job retention scheme, which paid most of the salaries for people who had become unemployed due to the coronavirus pandemic, but had been kept on the payroll by companies.

This program was eventually extended until spring after the government announced a second national lockdown for England during the month of November as the number of people infected with the Coronavirus soared. Under this program, those eligible for the subsidy will receive 80% of their salaries paid by the government.

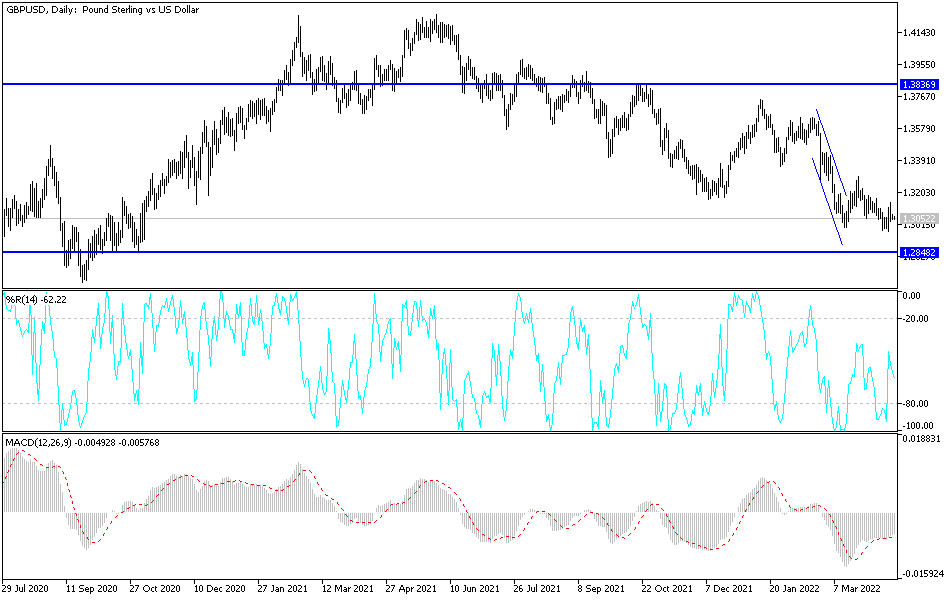

Technical analysis of the pair:

The GBP/USD performance is still unstable, awaiting Brexit developments. An agreement would bring more gains for the pound against other major currencies, which are currently closer to breaching the 1.3500 resistance, which spurs the bulls to push further. A positive closing of this file means an opportunity to move towards psychological resistance at 1.4000 before the close of transactions in 2020. On the downside, the pair's gains are moving technical indicators towards strong overbought levels. Failure to reach a Brexit agreement would mean a rapid collapse of the pound, and we would not rule out reaching the support levels at 1.3000 and 1.1960, respectively.

Today's economic calendar:

Regarding the GBP, inflation figures will be announced according to the CPI and producer prices reading, then the Manufacturing and Service PMI reading. Regarding the USD, the retail sales figures, the Industrial and Service Purchasing Managers Index, and the monetary policy decisions of the US Federal Reserve and the statements of Governor Jerome Powell will be released.