Short trade ideas

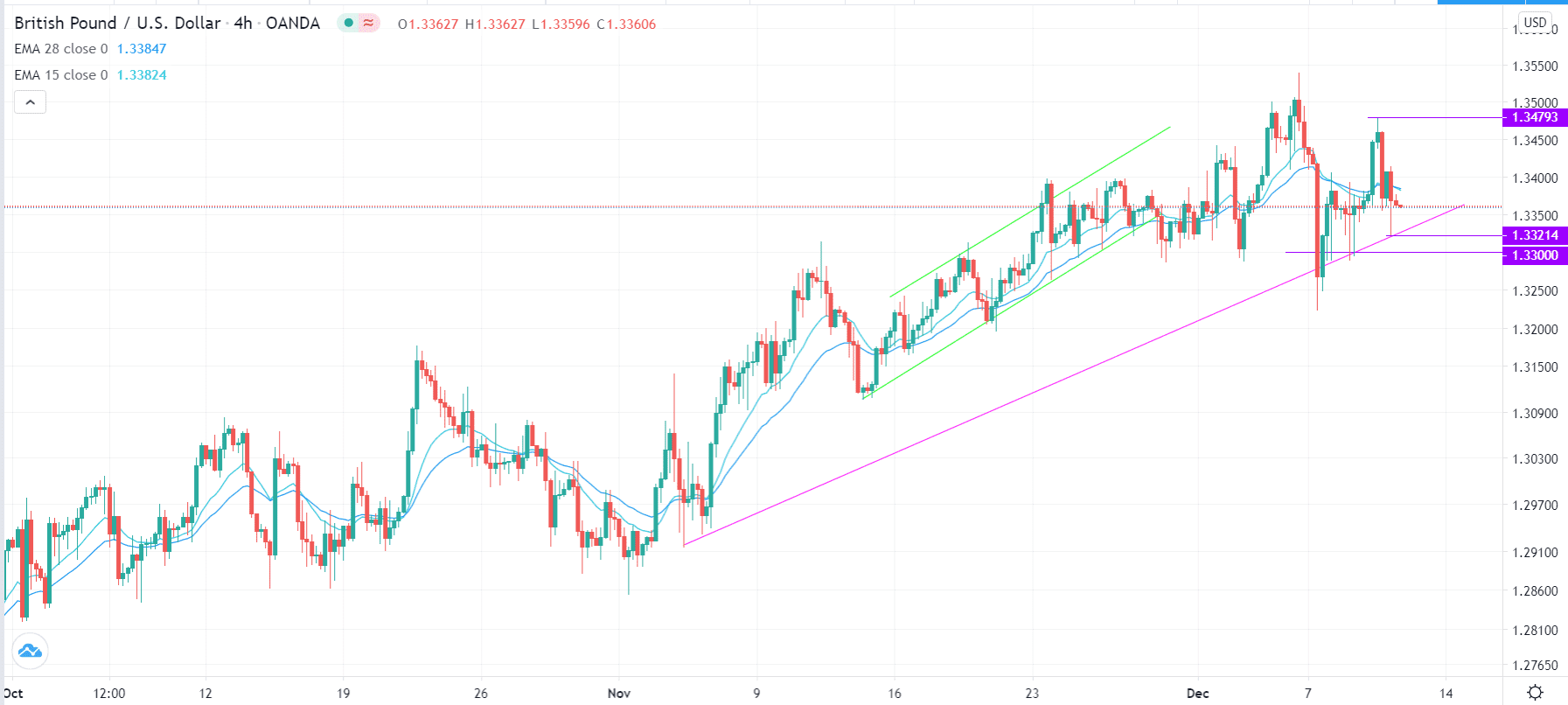

Go short if the price moves below 1.3321, which is the lowest level today.

Add a take profit at 1.3300 for a ~20 pip profit.

Put a stop loss at 1.3385, which is the 14-period and 28-period EMA.

Long trade ideas

Go long if the price moves above 1.3400, which is an important psychological level.

Add a take profit at 1.3450 and a stop loss at 1.3320.

The GBP/USD is wavering today after last night’s meeting between Boris Johnson and Ursula von der Leyen, the President of the European Commission. The two leaders deliberated on key Brexit issues and ended without any progress.

Instead, they asked their team of negotiators to accelerate talks and issue a final outcome by Sunday. With EU leaders having a meeting today, the GBP/USD will react to any statements they make. Just yesterday, in a warning to the UK, Angela Merkel warned that the bloc was preparing for a no-deal situation.

The pair will likely react mildly to the important economic data from the United Kingdom. The Office of National Statistics (ONS) is scheduled to release the GDP, trade and production numbers at 07:00 GMT.

Economists polled by Reuters expect the data to show that construction output rose by 1.0% in October, a decline from the previous 2.9%. They also expect the industrial and manufacturing production to have dropped by an annualised rate of 8.4% and 6.5% in October. With so much focus on Brexit, these numbers will likely have no major impact on the GBP/USD price.

Meanwhile, across the pond, the Bureau of Statistics will publish the US inflation data for November. Economists expect the data to show that the headline CPI rose by 1.1% in November from 1.2% in the previous month. They also expect that the core CPI will remain at 1.6%, which is below the Fed target of 2.0%.

GBP/USD Technical Analysis

The GBP/USD has been relatively volatile lately. This week, it fell to a multi-week low of 1.3223 and then bounced back to yesterday’s high of 1.3480.

The price is being supported by the rising pink trendline that connects the lowest level on November 4 and 5 and December 8. It also formed an evening star pattern yesterday.

Notably, the pair has also moved below the 14-period and 28-period exponential moving averages, implying that buyers are under pressure.

Therefore, while the pair could experience volatility today, the most likely outcome is where it pulls back and retests the intraday low at 1.3320. If it moves below that level, the next potential target will be the psychological level at 1.3300.

On the flip side, a powerful move above the psychological level at 1.3400 will mean that there are still some buyers left. That will see them target yesterday’s high at 1.3480.