After reviewing the GBP/USD Forex signal on the 16th of December, we find that the pair has not activated any buy or sell order.

Short Trade Ideas

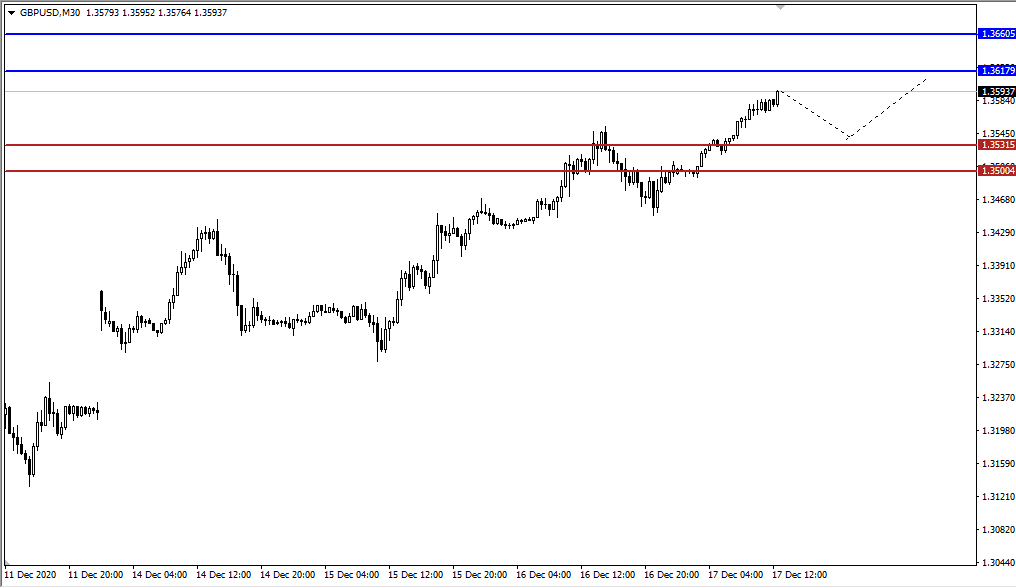

The best short trading ideas today are from the following levels: 1.3660 and 1.3711.

Stop losses in the short strategy should be placed specifically at the 1.3749 level.

Collect profits on an average of 30 to 50 pips from each level.

Stop loss is moved to the entry point when making 20 pips in profit.

Long Trade Ideas

The best long trade today is from the following levels: 1.3531, 1.3500.

Stop losses in the long strategy should be placed at the 1.3407 level.

Collect profits on an average of 30 to 50 pips from each level.

Stop loss is moved to the entry point when making 20 pips in profit.

Money Management Strategy

Use 1% to 2% of your portfolio value for all trades and distribute this percentage on the stop loss points.

GBP/USD Technical Analysis

The GBP/USD surpassed its highest levels since April of 2018, as optimistic Brexit news and the dollar's decline pushed the pair to jump above the highest resistance levels at 1.3546.

There was a tone of cautious optimism regarding the statements of the European and British sides, amid expectations that a trade agreement between the two parties would soon be reached before the year's end deadline.

Congressional statements about working to pass the fourth relief bill before Christmas contributed to pressure on the weak dollar, which continued in the general declining trend after the FOMC announced the fixing of interest rates and Jerome Powell’s statement. Powell indicated that the current rise in COVID-19 cases may cause an economic downturn in the first quarter. However, he said that since vaccinations will also begin in the first quarter, the exact impact of coronavirus in the coming year remains uncertain.

Technically, the GBP/USD pair is trading in a general bullish trend above the support level on the weekly chart at 1.3531, and the pair is heading towards the resistance level at 1.3621. The pair is considered for buying only, and it is not possible to think of going against the general trend except by exploiting corrections to enter long positions.

The best intraday selling levels are considered at 1.3660, 1.3711.

The best intraday long levels are considered at 1.35310, 1.35000

GBP/USD Fundamental Analysis:

Today, at 12:30 KSA time, we have a statement from the BoE regarding the interest rate decision, which is expected to remain as is.