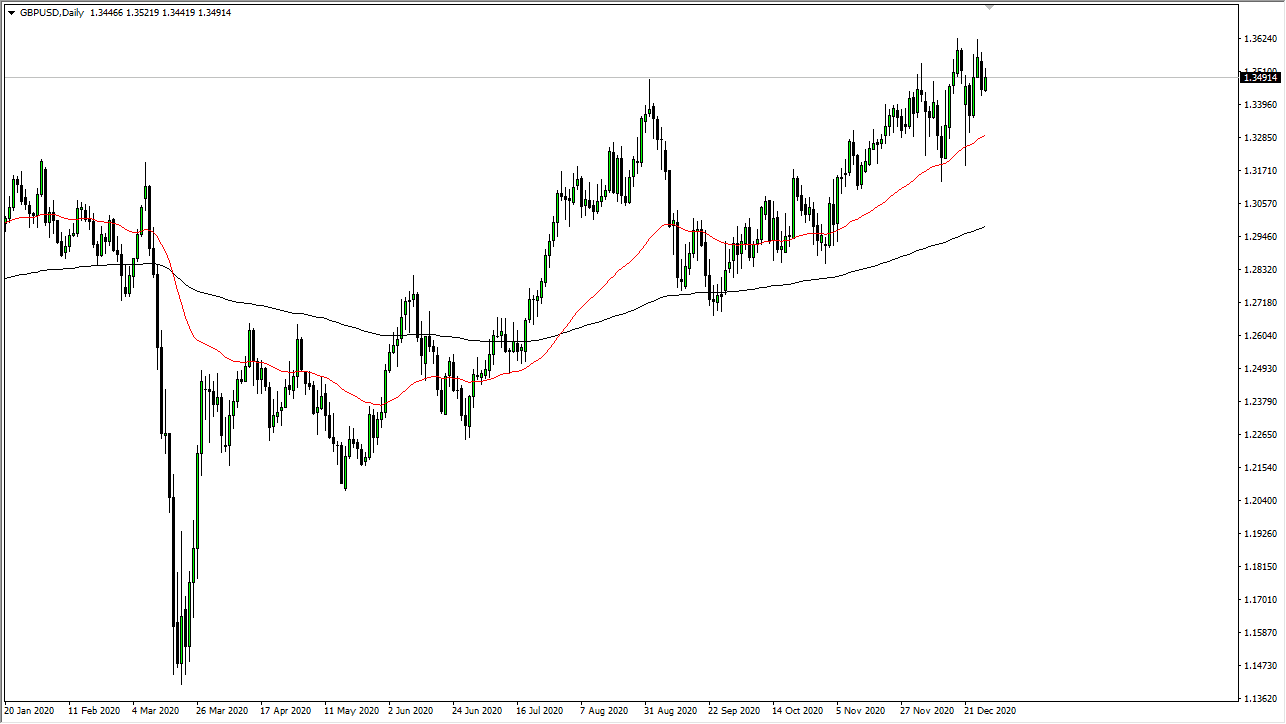

The British pound initially rallied during the trading session on Tuesday, breaking above the 1.35 handle yet again. However, just as we have seen before, sellers came back into the marketplace and pushed the British pound back below the 1.35 handle. With stimulus coming out the United States, it makes sense that we would continue to see the British pound gain on that reason alone, as it is a relative play against the greenback.

This is not to say that the British economy is suddenly going to turn around completely, but now that we actually have a Brexit deal signed, at the very least we can have some stability when it comes to the British economy and the flow of goods between the UK and the EU. Now that we have avoided massive tariffs, that should continue to benefit the British economy in general over the longer term.

This is not to say that the British pound will not pulled back significantly occasionally, because there are a lot of headaches in the future when it comes to the UK economy. Furthermore, we have coronavirus lockdowns going strong in the United Kingdom, so that is going to work against the value of any type of economic recovery. As long as that is going to be the case, then you continue to buy dips, with an understanding that perhaps the British pound will be one of the underperformers against the greenback. This is not to say that you cannot make money in buying this pair, rather it is to say that you may make more money buying something like the Australian dollar, the euro, etc.

To the downside, I see the 50-day EMA painted in red on the chart as a potential support level, close to the 1.33 handle. It has already been tested several times and proven itself to be technically sound as far as support is concerned. If we break down below there, then we will go looking towards the 200-day EMA underneath there, closer to the 1.30 level, which is a large, round, psychologically significant figure that will attract a lot of attention. To the upside, I believe the British pound may go looking towards the 1.3750 level over the next several weeks, so that would be a target at which I would be looking for a breakout.