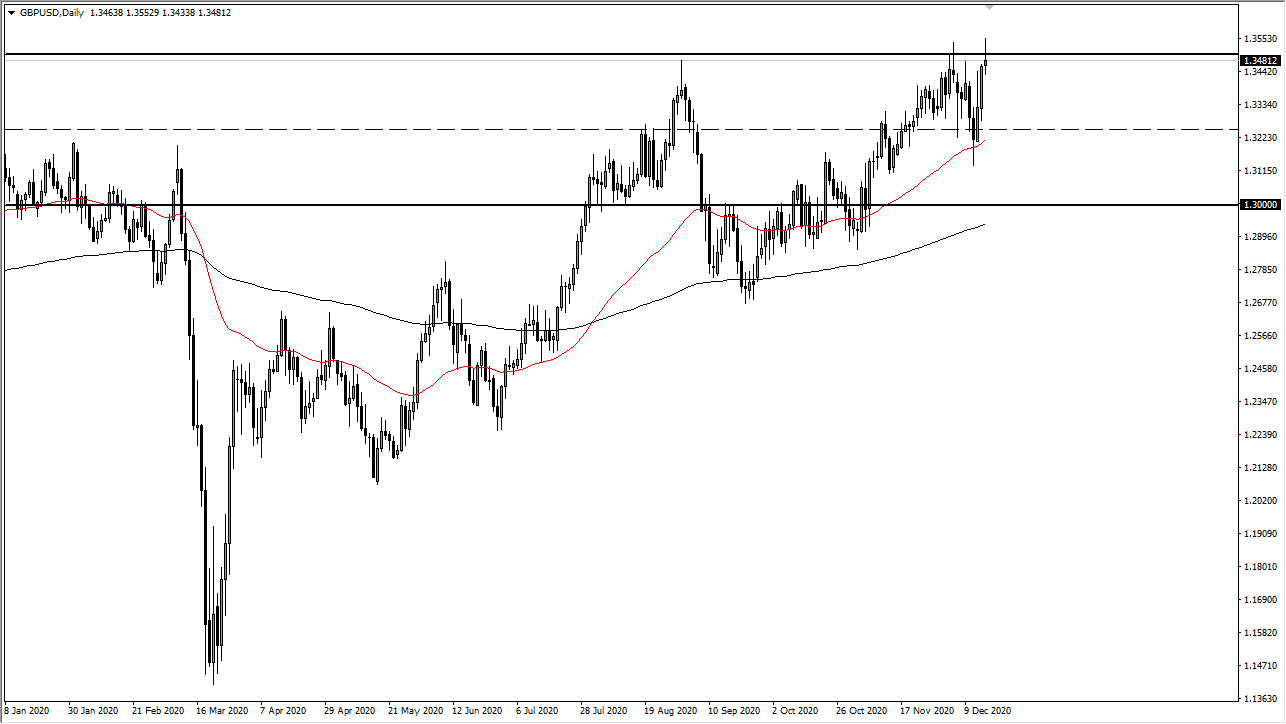

The British pound rallied significantly during the trading session on Wednesday, piercing the 1.35 handle, an area that continues to cause issues for the pound. This is a market that has tried to break out, but still waits to see whether or not we can get a catalyst coming out of the Brexit negotiations to shoot to the upside. On the other hand, the market is likely to see a lot of volatility and choppiness, so a short-term pullback is possible, especially considering that we formed a shooting star for the day.

If we break down below the bottom of the day, then we have a setup for a potential short. Do not get me wrong; I am not willing to take that trade, though I know certain traders will be looking for that. I suspect more people will be interested in looking at this market for potential value every time it offers it, as the British pound obviously is starting to try to price in the Brexit working out. There certainly seem to be more conciliatory tones coming out of participants in the Brexit negotiations, so it does make sense that we would continue to see buyers interested in the British pound.

The 50-day EMA sits underneath the most recent action, near the 1.3225 level, so the 1.3250 level will be an area that a lot of people will be watching. This market is probably going to try to go towards the 1.3750 level, possibly even the 1.40 level once we get a deal between the European Union and the United Kingdom. Many things will continue to be difficult between now and then, but given enough time, we will more than likely see a “FOMO” situation as soon as we get good news regarding Brexit. There are plenty of buyers underneath, so I will be looking at short-term pullbacks to take advantage of what will clearly be a potential longer-term trade. A little bit of patience could go a long way.