The British pound initially spiked higher during the trading session on Thursday as Boris Johnson and Ursula von der Leyen crossed the finish line. It is a bit telling that the market gave up the gains for the trading session. After all, the market has been riding the euphoria wave for some time, and the fact that the Brexit deal is done now and we rolled over tells me that perhaps this is a bit of a “sell the news” type of event.

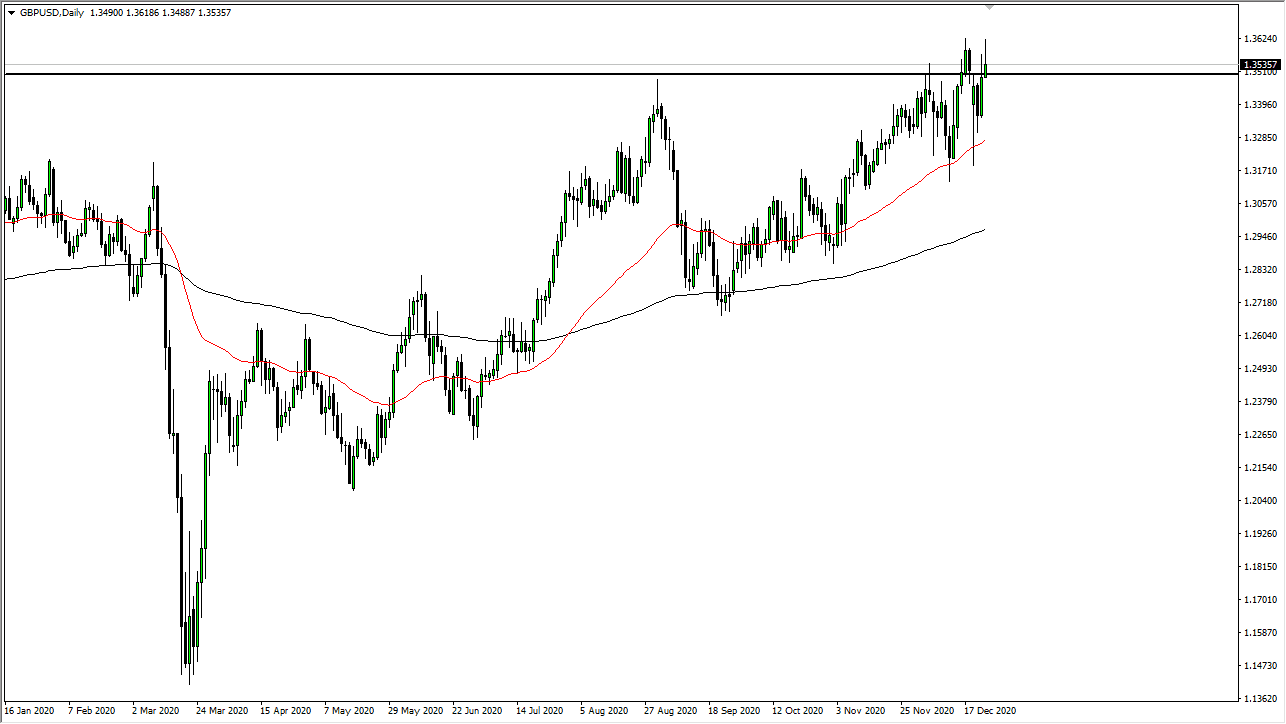

Looking at this chart, you can see that the area between the 1.35 level and the 1.36 level has offered resistance previously, and the fact that the market pulled back the way it has during the day on Thursday is something worth watching, given the market's reaction. However, you should also keep in mind that it was the day before Christmas, so there would have been a serious lack of liquidity. This means that we may see this market turn right back around and break to the upside, but even if we do that, it is only a matter of time before we would run into selling pressure, especially near the 1.3750 level, which is my next target.

To the downside, the 50-day EMA should offer a significant amount of support, especially near the 1.33 level, so we will see a value proposition in that area. However, we have yet to read the text of the Brexit deal, so it will be interesting to see how this plays out. Furthermore, we have to pay attention to the UK economy now, as Brexit is going to be on the back burner. Locking down the UK economy with the coronavirus mutation is not going to help anything, so the next couple of weeks will be very noisy. Eventually, though, we should see an impulsive move which clears up the situation. We cleared a major hurdle during the day on Thursday, and now the market will begin to shift its focus. One thing that could help this market go higher is the fact that there is a strong “anti-dollar” feeling out there, so it could rise from that reason alone.