The Brexit negotiations failed to make a breakthrough during the trading session on Tuesday, but it does look as if the negotiators are willing to try to fix the situation. This is the most important thing for the British pound in general, and as we head into the Wednesday session there are still people calling for an agreement this week, but it is obviously getting to be difficult. As things stand right now, the biggest argument is going to be fisheries, which has been a thorn in the side of negotiations over the last couple of weeks. The real sticking point seems to be between the English and the French.

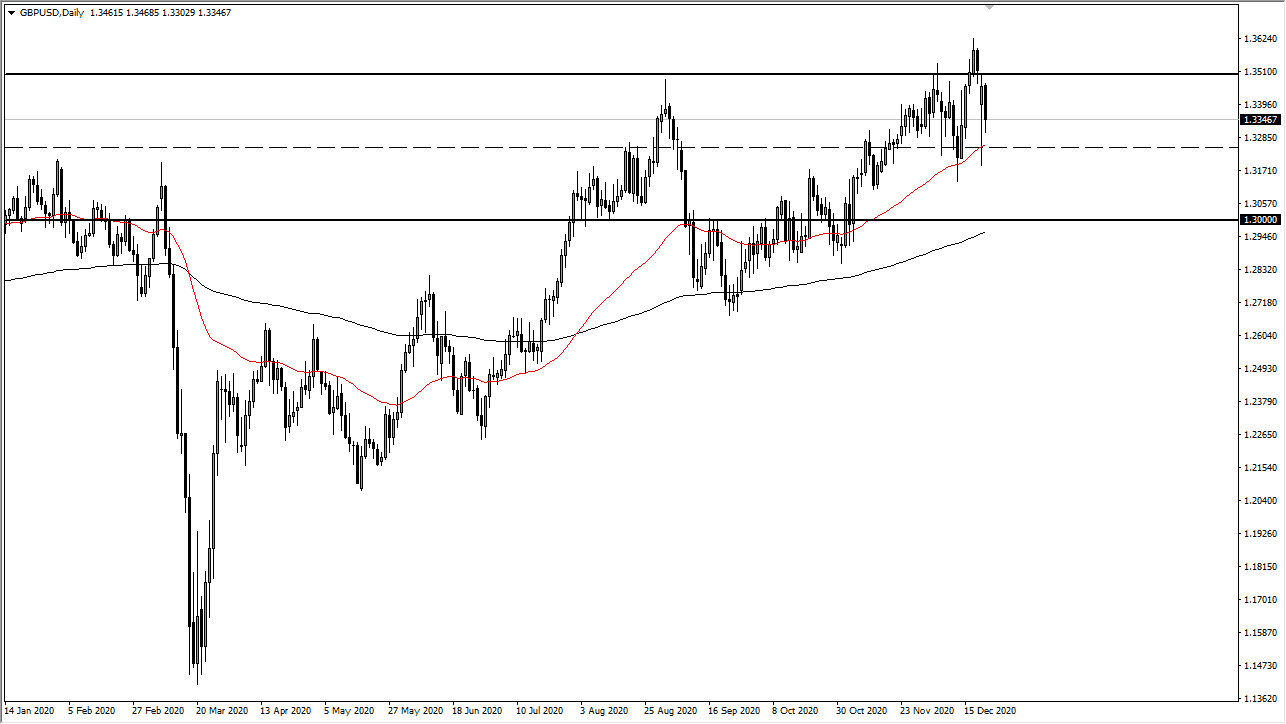

Though it fell, the market did not fall as hard as the previous session, which I found a bit interesting. Given enough time, the market is likely to turn around and try to rally, because "hope burns eternal" for the British pound and a Brexit resolution. I suspect that is the pattern that we will continue to follow between now and the end of the year, but we are most certainly running out of time. To the upside, we could go towards the 1.35 handle, which is a large, round, psychologically significant figure and an area that had previously been resistance, although it has been broken once.

To the downside, the 50-day EMA is sitting just below the 1.3250 level, which is the middle of the larger consolidation area, and where we see the 50-day EMA crossing right now. The 50-day EMA is sloping to the upside, which means that we should see a certain amount of support based upon that indicator as well. We will continue to see buyers on dips, so I do not have any interest in trying to get too cute and short this market. If we get positive movement in the Brexit negotiations, that will send this market to the upside and go screaming towards the highs. We are in an uptrend, at least until the inevitable “no-deal Brexit” would come to fruition. As things stand right now, it looks like we will continue to negotiate, and therefore there is still hope.