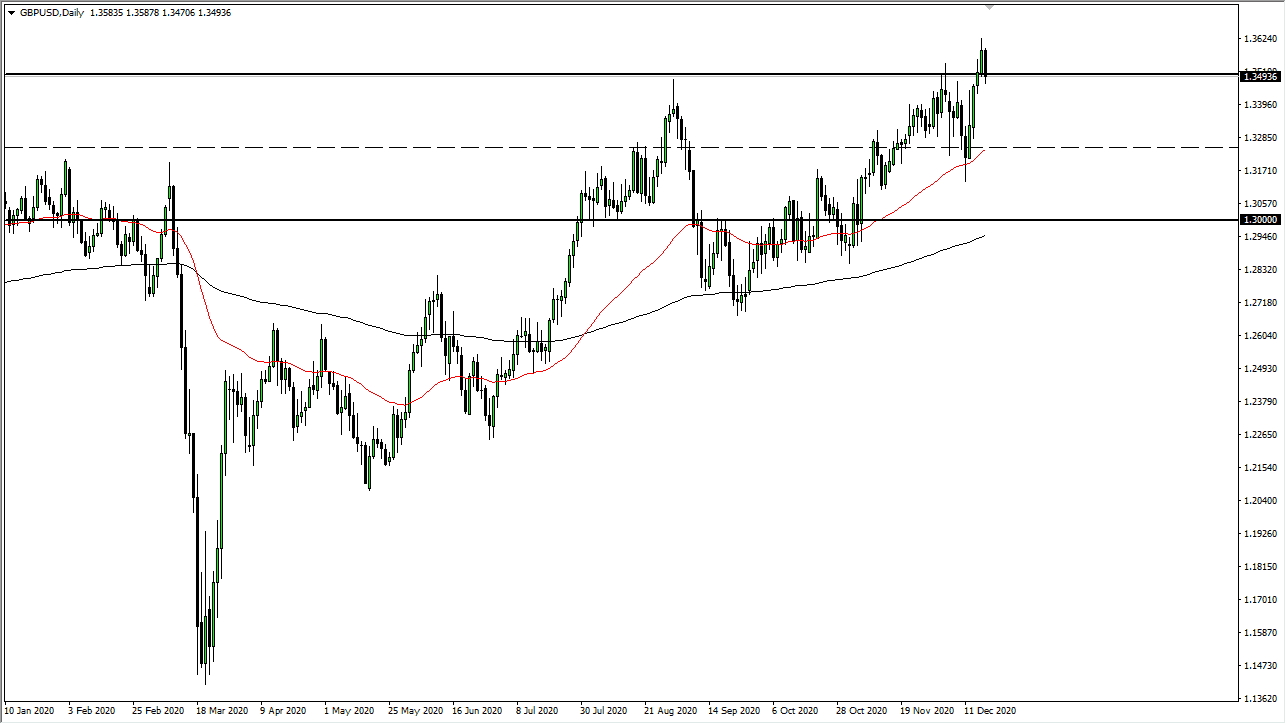

The British pound pulled back during the trading session on Friday to dip down below the 1.35 handle again. The market is waiting for some news on the Brexit front that can get things moving and is trying to break out, but we are waiting to see whether or not the United Kingdom and the European Union can finally get it together. Until they come to a deal, the British pound will continue to be negative until we get closure. Once we do, the British pound will take off to the upside is in a massive move.

The size of the candlestick is not necessarily anything to be overly concerned about, and it is interesting that we are closing right here at the 1.35 handle. The market will continue to find buyers on dips, because that is what we continue to do. The 50-day EMA is sitting at the 1.3250 level, and that is an area that should continue to offer a “floor" in the market as well. Furthermore, the United States is still discussing stimulus, and that could weigh on the US dollar as well. There are still a lot of moving pieces, and as we go into the weekend, it is hard to tell whether or not we will get any clarity, but one would think that sooner or later somebody has to finally make a decision on some of these big questions.

It certainly looks as if the market is trying to make a longer-term decision in the British pound, and if we do get a Brexit deal, it is possible that we could go as high as 1.45 over the next several months. We could even be looking at the 1.48 level after that. I do not have any interest in shorting the British pound, because regardless of what happens, it seems like there are people out there willing to pick it up. If we did get a “no-deal Brexit”, I suspect that we would get a massive selloff, followed by a small basing pattern, followed by the deal of a lifetime if you are willing to buy the British pound and hang on to it.