The British pound fluctuated during the course of the trading session on Monday to kick off the week, as we continue to see a lot of choppy volatility. The thing about the British pound is that “hope burns eternal”; so even though we continue to see a lot of discourse when it comes to the messages being put into the media by politicians, the reality is that most people are pricing in the fact that there will be a Brexit deal.

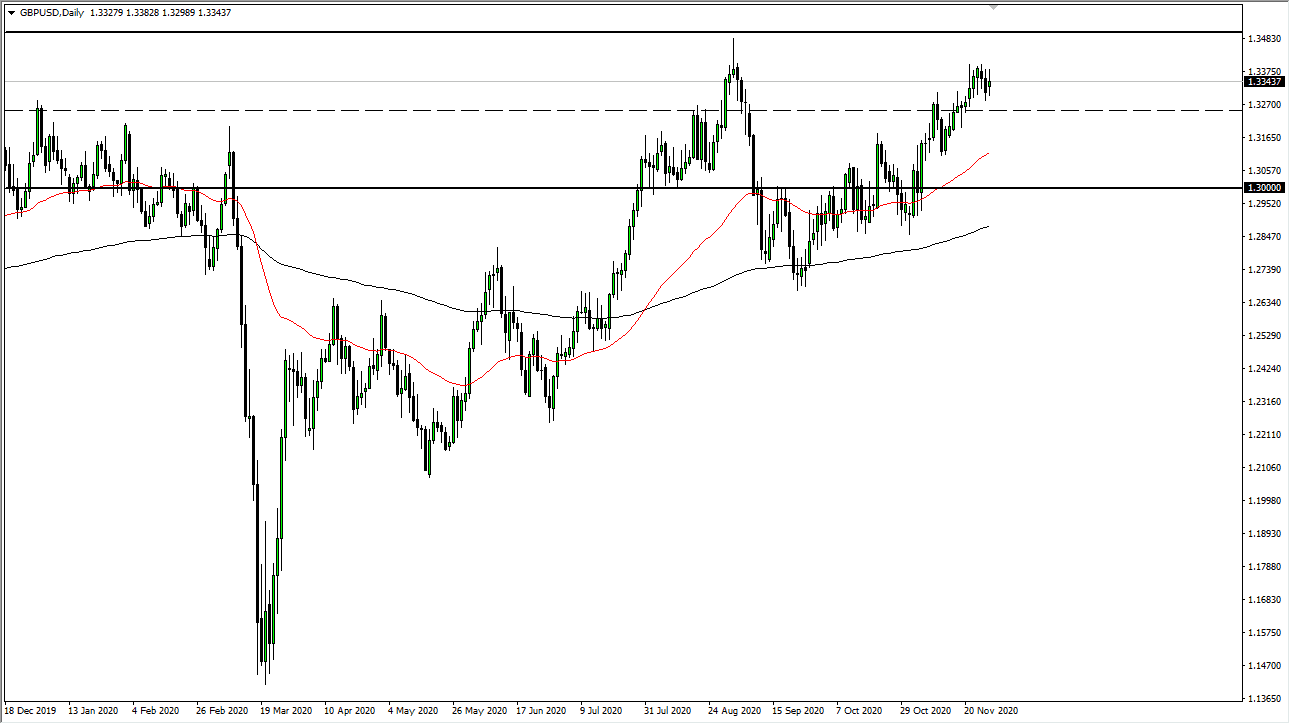

All of these months we have seen both sets of politicians trying to act hardline and tough, but at the end of the day they continue to come back to the negotiation table. There is no real will on either side to break this apart without a deal. I would not be overly surprised to see if somebody tried to kick the can down the road again. Nonetheless, there will be some agreement (at least that is what the market consensus is), and people are pricing in that. You need to keep thinking of it in those terms: what the market is pricing in. This is a market that will go looking towards the 1.35 level again, which is the all-time high. Once we get there, good Brexit news might be all it takes to finally break that barrier and go looking towards 1.3750 level above.

As far as shorting is concerned, I have no interest in doing so; although, I do recognize completely that we could fall from here and struggle in the short term. I suspect that the 1.3250 level, the 1.32 level, and most certainly the 1.31 level should offer support. We also have the 50-day EMA which is racing towards 1.31 handle, so I look at dips as continued value propositions. Longer term, the consensus is to short the US dollar and buy other currencies, especially an undervalued one like the British pound.