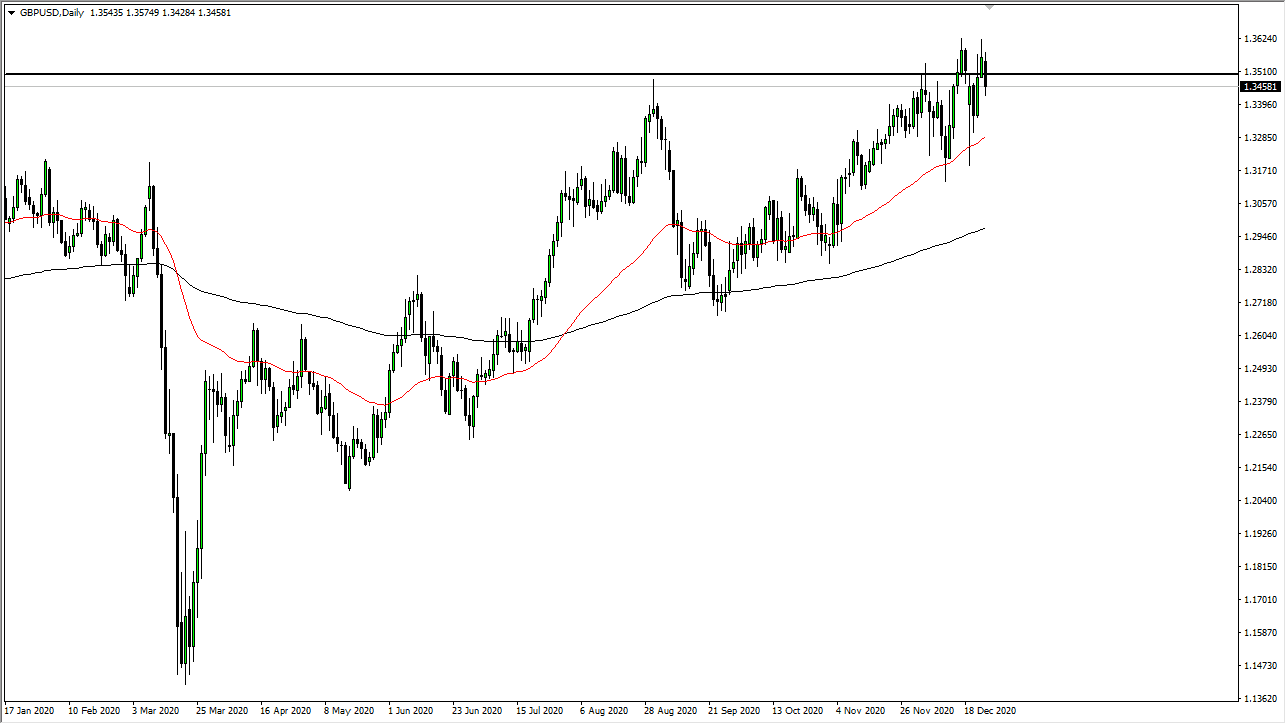

The British pound initially tried to rally during the session on Monday, but then broke down below the 1.35 level to show signs of weakness. This is a market that has been extended for some time, and now people need to take stock of the Brexit deal itself. After all, we have been playing the “binary game” of whether or not we will get a deal or not for so long, and the entire game has changed quite a bit. At this point, people are going to start focusing on what is in the Brexit deal and how the United Kingdom economy is actually starting to perform.

With the coronavirus lockdown slowing things down, it shows that the UK economy should be struggling, which could weigh upon the British pound at least in the short term. We need to pay attention to the US dollar as well, due to the fact that the stimulus bill has now been signed, which should bring down the value of the greenback. However, we also need to realize that there are a lot of questions going on at the same time and there is a significant lack of volume in general. In other words, we could get sudden moves like we had on Monday, but it does not necessarily mean that we are making any type of significant longer-term move.

When you look at the overall trend, though, we are most certainly in a bullish trend, so it is going to take a lot to change everything. The 50-day EMA below at just below the 1.33 handle should offer a bit of a floor, and if we were to break down below there, then we could start to look at the market in a different light. In the short term, it is only a matter of time before we find a certain amount of value that people may use. The British pound may have been in danger of being overbought over the last couple of months, but longer term, we will continue to see the British pound rise due to the fact that it is historically cheap. All the way down to the 1.30 level there will be plenty of possible buying opportunities, but we would need to see asupportive daily candlestick.